Compared to all the types of debt you could have, student loans aren’t that bad.

The interest rates are likely lower than credit card debt or other types of consumer loans. If you have federal student loans, you have a variety of protections available in case you lose your job or become disabled. And, hopefully, taking out all those loans was worth the education you received in exchange.

Still, student loans are debt. This debt limits your options for putting your money to better uses, whether saving for a home or investing for your future. The faster you can pay off your loans, the faster you can have full control over your money.

To help you get out of debt more quickly, we’ve put together this guide to paying off student loans.

Below, you’ll learn everything from how long it takes to pay off student loans to how to reduce your interest rate. By the end, you’ll be well-equipped to tackle your student loans, no matter how much you owe.

This article assumes you understand the basics of how student loans work. If you need a refresher, read this.

How Long Does It Take to Pay Off Student Loans?

The precise answer to this question depends on the type of loan, the total loan amount, and your repayment plan.

Assuming you only have federal student loans, you’ll be on the Standard Repayment Plan by default. Under this plan, you’ll pay at least $50 per month and pay off your loans in 10 years or less.

If you’ve consolidated your federal student loans using a Direct Consolidation Loan, then you’ll pay off your loan in between 10 and 30 years. Your monthly payment will also be a fixed amount of at least $50.

Things get a bit more complicated if you’re on an income-driven repayment plan. These plans are customized to your specific financial situation, so it’s hard to give one answer to how long it will take to repay. You’ll find out the details when you apply for income-driven repayment.

If you have private student loans, then your lender will set the repayment terms. You should consult with them to see how long it will take to pay off your loan at your current monthly payment and interest rate.

How to Pay Off Student Loans Faster in 5 Steps

You’ll typically pay off your student loans in 10-30 years if you make the minimum payment each month.

But what if you want to pay off your loans faster? In that case, keep reading to find out how you can accelerate your student loan repayment:

1. Find Extra Money

To pay off your student loans faster, you’ll need to make more than the minimum payment each month. And for this, you’ll need to find some extra money.

You can get this extra money in two possible ways:

- Make extra money and put that towards your payments.

- Spend less money and put the difference towards your loan payments.

Both of these approaches have merit, and we encourage you to combine them!

To find ways to make extra money, check out our guide to making an extra $1,000 / month.

And on the spending less money front, I recommend this list of 25 ways to save money.

No matter which approach you take, even finding an extra $100 a month to put towards your student loans can meaningfully reduce what you pay overall.

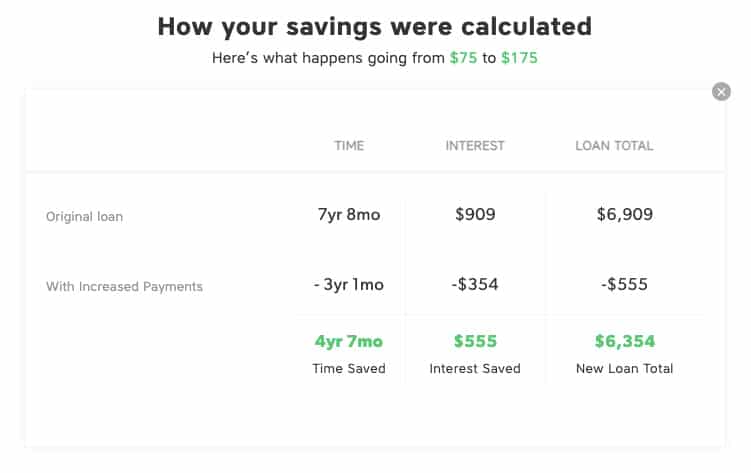

As a simple example, let’s say you have a $6,000 student loan at an interest rate of 3.73%. If you pay $75 per month, then you’d pay off your loan in ~8 years and pay $909 in interest.

But what if you upped your payment by $100 per month? In that case, you’d pay off your loan in just over 3 years. And you’d only pay $354 in interest, a savings of $555. It’s a simplified example, but it shows the power of accelerating your payments.

In the real world, however, you likely have more than one student loan. Keep reading to find out which one you should pay off first.

2. Decide On Your Repayment Approach (Avalanche or Snowball)

If you attended college for at least a few semesters, then you probably have several student loans of varying amounts and interest rates. This can make it hard to know where to start when accelerating your repayment.

There are two main approaches you can use to decide which loans to pay off first: the debt snowball and the debt avalanche.

The Debt Snowball

With this method, you pay the minimum on all your loans and then put extra money towards the loan with the lowest balance.

So if you have a $700 loan, a $1,000 loan, and a $1,200 loan, you’d put all your extra money towards the $700 loan. Once you paid off that loan, you’d repeat the process for the $1,000 loan and then the $1,200 loan.

The psychology of the debt snowball method can be very motivating. Starting with the smallest loan gives you a quick win, which can then give you the momentum to tackle the larger loan balances.

However, the debt snowball method isn’t optimal if your goal is to pay the least amount of interest possible.

For instance, let’s say that your $700 loan has an interest rate of 3%, but your $1,2000 loan has an interest rate of 5%.

While you’re putting extra money towards that $700 loan, your $1,200 loan continues to accumulate interest at a higher rate. This ends up costing you more money in the long run.

The Debt Avalanche

With this method, you make the minimum payment on all your loans and put extra money towards the highest-interest loan.

Once you’ve paid off the loan with the highest interest rate, you move to the loan with the next-highest rate. You then continue the process until your debt is gone.

Mathematically, the debt avalanche is better than the debt snowball. Because you focus on the highest-interest loans first, you’ll pay less in interest overall.

However, the debt avalanche method requires discipline. You won’t see the same instant results as with the snowball approach, which can be demotivating. But if your goal is to pay the least interest possible, the debt avalanche is the way to go.

Want to compare the debt snowball and avalanche methods using your real loan amounts? Check out this calculator.

3. Sign Up for Auto-Debit

To avoid missed student loan payments, sign up for auto-debit. This way, the minimum payment will automatically come out of your bank account each month.

Besides the peace of mind it brings, auto-debit could help you pay off your loans faster. Many loan servicers offer a 0.25% interest rate reduction when you sign up for auto-debit. It may not sound like much, but every little bit helps!

4. Consider Refinancing

If you have lots of student loans at different interest rates, refinancing could help you pay off your debt faster.

When you refinance your student loans, a private lender combines your various student loan balances into a single, new loan. You then repay this loan at the interest rate your lender sets.

In some cases, refinancing your loans could qualify you for a lower interest rate. If this is the case, you might be able to pay off your debt faster. Refinancing will also simplify your payments, requiring you to keep track of only one monthly amount.

Just be sure you understand the risks of refinancing. If you refinance your federal student loans, for example, you’ll lose the protections they come with. To decide if refinancing your student loans makes sense, check out our detailed guide on the subject.

5. Look Into Loan Forgiveness Programs

In certain specific circumstances, the federal government will forgive all or part of your federal student loans. If you have a particularly high loan balance, this financial relief could be life-changing.

The two main loan forgiveness programs to know are Public Service Loan Forgiveness and Teacher Loan Forgiveness. Here’s a brief overview of each:

Public Service Loan Forgiveness

With Public Service Loan Forgiveness, the federal government “forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.”

Basically, if you work for a government employer, non-profit organization, or AmeriCorps/Peace Corps, you can get your loans forgiven after you make 120 payments.

There are lots of specific stipulations, though, so be sure you understand the details before you take this path.

Public Service Loan Forgiveness makes the most sense if you plan to work in government or nonprofit work for at least 10 years and have a loan balance so high that you wouldn’t be able to pay it off in 10 years or less.

Teacher Loan Forgiveness

Under the Teacher Loan Forgiveness program, you may be eligible for federal student loan forgiveness “if you teach full-time for five complete and consecutive academic years in a low-income school or educational service agency.”

How much forgiveness you can get depends on what you teach.

Full-time secondary school math or science teachers can be eligible for up to $17,500 of loan forgiveness. Special education teachers working at either the elementary or secondary school level can also be eligible to have up to $17,500 forgiven.

If you don’t meet these requirements but are still “a highly qualified full-time elementary or secondary education teacher,” then you could be eligible for up to $5,000 of student loan forgiveness.

The full requirements are a bit too complicated and specific to discuss here at length. But if you’re interested in Teacher Loan Forgiveness, you can learn more here.

You Won’t Pay Off Your Student Loans Overnight

You now have the information you need to pay off your student loans faster. But no matter how much you know, the process will still take time.

At first, you might only be able to pay an extra $25 per month, and that’s okay. You’re still reducing the time you spend in debt and the interest you pay overall.

Need a bit of inspiration? Check out the story of how our founder paid off $14,431 in student loans while he was still in college.

Image Credits: woman drawing on tablet