Remember the Mega Maid from Spaceballs?

You know, that star-cruising, colossal, maid-shaped ship with a gargantuan vacuum bent on stealing all the oxygen from an entire planet?

That’s what college is. College is a giant, evil space vacuum hell-bent on siphoning every last dollar you have into its infernal space-vacuum bag.

“Mom, why do I hear Rick Moranis laughing maniacally in my head every time I heat up a bowl of ramen?”

Think of your degree as your giant robot pilot’s license. With it, you might be able to take down the Mega Maid after graduation and get that money back.

I’m not going to tell you how to get your pilot’s license today. Instead, I’m going to give you a few rubber bands you can shoot at the maid, which might buy you some time to stash a bit of money where it can’t be sucked away.

Here are 39 ways you can cut the cost of college, which include:

- Ways to massively reduce the cost of your education

- Frugality tips, with useful tools

- Methods of making money in college – which will help you take on less debt

Let’s do this.

1. Set a realistic baseline for your college choice, then shoot for the moon.

No other choice has the potential to save or cost you as much money as your choice of college. That’s why I wanted to start with this tip.

If you’re still looking for a college, choose an in-state, public university as your baseline choice. For the most part, these are the schools where you will end up paying the least for your education. It’s not always the case, but on average, it’s the best option.

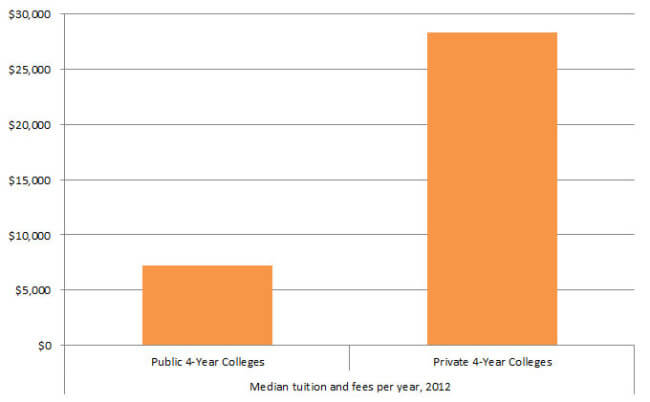

Using data from NCES, I made a simple chart that shows you the median tuition for in-state, public universities vs. private ones in 2012 (the most recent year available):

Now, is this to say you absolutely should go to a public college? No. If you can win scholarships or grants that make the price of a private college lower, go for it! But if you have to take out loans, don’t get your heart set on a more expensive school before that happens.

More more on why public universities are a good choice, check out Chapter 5 of Zac Bissonnette’s excellent book Debt-Free U.

2. Consider community college.

I recently read an article on CNN Money about community college grads that are out-earning people with bachelor’s degrees. Here’s a statistic that stood out to me:

“Nearly 30% of Americans with associate’s degrees now make more than those with bachelor’s degrees, according to Georgetown University’s Center on Education and the Workforce.”

As someone who believes investing personal effort and learning how to market yourself affect your job prospects more than your choice of school, this doesn’t surprise me.

I’m not saying you should drop your plans of going to a 4-year school; however, I think it’s a good option if you’re really on a budget.

Beyond that, community college can be a great starting place for your education, since it’s way cheaper to do your general education classes there.

3. Live off-campus after your first year.

I loved living on-campus during my freshman year of college. Doing so put me really close to classes, right in the thick of all the opportunities, and helped me make lots of new friends quickly.

However, I quickly learned that living on-campus is expensive. You’ll most likely end up paying far less for your housing and meals by living off campus. Here’s a comparison for where I live:

- Rent: $460/month (dorm) vs. $320/month (apartment – which is way bigger)

- Food: $7.50/meal (campus meal plan – required) vs. $3.50/meal (based on a common stir-fry meal I make)

You’ll need to do the research in your area to see if this applies to you as well, but it most likely does.

4. Embrace minimalism.

I’m a huge fan of Joshua and Ryan, the two guys who run The Minimalists – a blog about living deliberately and avoiding a lifestyle of needless consumption.

Here’s their quick definition of minimalism:

“Minimalism is a lifestyle that helps people question what things add value to their lives. By clearing the clutter from life’s path, we can all make room for the most important aspects of life: health, relationships, passion, growth, and contribution.”

To me, minimalism means deliberately thinking about the things that add value to my life – and then focusing on those things instead of getting caught up in the rat race. Being a (somewhat) minimalist has helped me to:

- Convince myself that a ratty thrift store couch is ok – No Tom, the living room doesn’t need to be “tied together”

- Decide to keep my car even though it’s at 220,000 miles – I don’t value the car’s looks, I just value being able to get places

- Get rid of a bunch of stuff that just cluttered my room up – Having a clean living space helps me focus on my work better

Not surprisingly, the minimalist mindset can help you save money. It’s surprisingly easy to get caught up in less-than-deliberate consumption; when you have a mindset that stops it, your bank account stays fuller.

5. See if you can pay for your dorm monthly.

I once wrote about the one question that gets you farther than everyone else – which is, simply, the question that no one else thinks to (or has the guts to) ask in any given situation.

Here’s an example:

“I don’t want to pay a semester lump-sum for my dorm. Can I pay for it monthly?”

If you’re living in a dorm room, you might think that you have to pay for the whole semester up-front. That’s what I thought as a student; however, that isn’t always the case.

Looking at my school’s housing rates, I noticed that they offer monthly billing. However, this isn’t the default option, and there’s a deadline. It’s one of those things most students don’t see.

If you have an income that would allow you to pay monthly – but don’t have the cash to pay up-front – this option could save you from having to take out a loan (and paying interest later).

6. Build your own loft bed.

When I lived in dorms, there were three options for obtaining a loft bed:

- Rent one from the university

- Buy a pre-made loft kit from the hardware store

- Build it yourself

Renting and buying the pre-made kit were both options that cost over $100.

By deciding to build a loft bed yourself, you can save a lot of money. I build a crazy hanging loft bed for around $100.

You probably don’t want to build a crazy loft bed, so here’s a tutorial on Instructables for building one around $20. You’ll need access to tools and a bit of know-how, but as long as you can find them, this is a great way to save money.

7. Cook your own food.

Here’s a recipe for a healthy stir-fry I often make:

This meal is huge – when I make it regularly, I only need to eat twice a day. It’s also really healthy – I cook it with rice, chicken, eggs, spinach, onions, and bell peppers.

Oh, and it only costs about $3.50 per meal when you add up all the ingredients.

Cooking your own food is an awesome way to save money; it’s cheaper than a meal plan, and it’s definitely cheaper than eating out all the time. Here are a few tips for making it easier:

- Learn a few meals like the back of your hand – once they become an automatic process, it takes less willpower to cook

- Plan your meals in advance, then shop in bulk. You’ll end up wasting less food and time.

- Get a slow cooker – you can make a ton of cheap meals very easily (here’s a list of good ones)

If you’d like to learn more about eating healthily and cheaply in college, check out my guide on Nerd Fitness.

8. Hack your meal plan.

We’ve established that meal plans are expensive, but sometimes you still find yourself needing to have one. How can you cut the cost down?

Some ideas I’ve seen work:

- Cut down to a plan with only one or two meals a day. You really don’t need three.

- Eat more when you’re in the dining center, assuming it’s in the all-you-can-eat style.

- See if you’re allowed to bring food out and store it in a mini-fridge for later.

If you decide to cut down on your meal plan, but find yourself still hungry, there are lots of different foods you can make in your dorm.

I hardly ever talk about ramen on this blog because… it’s ramen. It’s 10 cents for a reason. Still, it exists.

Assuming you’ve got access to a microwave and mini-fridge, here are some more good options:

- Frozen chicken

- Steamer bags of frozen vegetables

- Eggs (yep, you can microwave them)

- Pasta

The Kitchn has some more great advice on making food in dorms as well.

9. Brew your own coffee.

I am in love with the white mochas the coffee shop right outside my apartment makes. They are my muse. They are also more than $4.

Yep, coffee from the coffee shop isn’t exactly cheap. Even the regular brewed coffee I buy costs more than a couple dollars – and that adds up when you’re trying to cut costs.

The solution? Brew it yourself. At the cheapest level, you can grab a cheap coffee maker at Wal-Mart and rock the Folgers with the milk and sugar.

If you’re a bit more of a snob than that like I am, you can go with the setup I use.

Aside from my delightfully geeky mug, my setup consists of:

The AeroPress is an awesome little gadget; it costs about $25 and makes delicious coffee.

The air pressure gives coffee the bold flavor you’d expect from a French press, but the paper filters let me use a super-cheap grinder without having to deal with bean particles getting in my coffee.

10. Keep applying for scholarships all throughout college.

Scholarships aren’t just for high school students; there are actually a ton of scholarships available for current college students.

In fact 5/6 of my scholarships were won while I was in college. For me, college turned out to be a better time to apply for scholarships, as I had a lot more experience and projects to show off.

In fact, my work in building this blog helped to win a $1,000 entrepreneurship award – twice. It turned out to be an impressive self-driven project, but I also believe it swayed the judges simply because I’d worked intensely on it.

Author Kristina Ellis – who won over $500,000 in scholarships – reinforces this idea in her book Confessions of a Scholarship Winner:

“Years of dedication to a few things you really excel in can be more appealing in scholarship applications than participating in a ton of activities that require little commitment.”

A few pieces of advice when looking for scholarships

- Focus on local scholarships first – those offered by your university or local businesses. (far less competition)

- Spend 30 minutes a week applying for scholarships.

- Your personal brand matters as much on scholarships as it does for job-hunting, so work on it.

For more information on getting scholarship, check out this in-depth guide.

11. Plan to be done in less than four years.

Do you really need to spend four years working on your bachelor’s degree, or is that just the default option?

Gene C. Fant Jr., dean of the College of Arts and Sciences at Union University, writes in the the Chronicle:

“It has always been possible for strong-willed students to complete their degrees early, either by abandoning the old agrarian academic calendar we still use or by availing themselves of dual-credit programs and examination credits.”

While he questions whether doing so is a good decision on the whole, his article points out that it is indeed possible.

If you’re finding that college is going to be a significant financial burden, this might be an option to look into. Some of the tactics you can use to get through your program include:

- Taking far more credits than normal per semester (possibly 20 or more)

- “Double dipping” – taking classes that fulfill multiple requirements

- Testing out of classes – CLEP tests, individual deals with professors, etc

- Negotiating to take classes concurrently with prerequisites

Unfortunately, this strategy can prevent you from focusing your efforts on other important things, like work experience, clubs, and social time. I believe it’s an option you should only take out of necessity.

12. Do college classes in high school.

I graduated high school with 49 college credits. By doing this, I was able to avoid taking a lot of intro-level classes in college: Calculus, English Composition, Accounting, Business Law, and lots of others.

Yes, my high school was pretty awesome – but you can probably do this as well. Here are some options for getting the ball rolling:

- Talk to your guidance counselor about dual-credit courses

- Take AP classes

- Call up a local college and ask what options they have for high school students – dual-credit, adult education, etc

- Look into taking a college course online

One more thing: Make sure the credit is transferrable! I knew I’d be going to Iowa State after I graduated, and I did the research to make sure my credit would transfer from the community college my high school was partnered with.

The last thing you want is to take a ton of college courses as a high school student, and then be told they’re not eligible to be transferred.

13. Get your textbooks for the lowest price possible.

If the Mega Maid had a Mini-Me, textbooks would be it. They’re overpriced, underused, and often aren’t even necessary. And yet, they cost the average student over $1,000 per semester.

That’s insane – and you should never pay that amount. Here are my strategies for finding the cheapest textbooks:

- Get your class and book lists as early as you can

- Email professors to ask how often the book is used and if an old/international edition is ok to buy

- Check your university library for the book (and see if it’s on reserve)

- Find older students to buy used copies from

- “Book gamble” – don’t buy your book until classes start (make sure you have a quick way to obtain it in this case)

- Share with other students

- Check new startups like Boundless and Packback for cheap alternatives to buying a book

- Use a price aggregator like StudentRate Textbooks to compare prices across multiple sellers

For for in-depth tips, check out my comprehensive guide to finding cheap textbooks.

14. Avoid private loans like the plague.

In Debt-Free U, one of my essential books for students, author Zac Bissonnette makes a bold statement:

“Neither you nor your child should ever, under any circumstances, ever, take out any private student loans.”

I tend to agree; while federal loans come with plenty of repayment, forgiveness, and deferment options, private loans have almost none. Once they start crushing your soul, they’ll just keep on doing it.

If you end up saddled with private loan debt you’re finding hard to pay, your only options are:

- Looking into consolidation options (which aren’t always a better deal)

- Trying to negotiate directly with your lender for better terms

- Using the stack method to pay them off as quickly as possible

None of those options will forgive the debt, unfortunately. And, contrary to what some people think, you can’t bankrupt your student loans.

Please, avoid private student loans if it’s at all possible. There are plenty of other options for financing your education.

15. Get a part-time job or side hustle.

Before I even started classes during my freshman year, I got a 20 hour/week job on campus.

Throughout my college career, I worked as a:

- Tech support rep

- Virus removal dude

- Web developer (employee)

- Web developer (freelance)

- Freshman orientation assistant

- RA

- Career center front-desk clerk

- Videographer

- Research department IT assistant

As you can probably surmise, I gained a lot of experience relevant to my major through my part-time jobs.

I can remove a virus, build a website, give a campus tour, speak to an audience of 500 people, comfort a scared student, do any administrative task, shoot and edit a professional video, and build an automation script that finishes a 230-hour job in less than 3 hours.

Aside from all that experience (which made finding subsequent jobs quite easy), my part-time gigs always kept money in my pocket. I never really had to worry about whether going to the movies would empty my bank account.

16. Cut your cell phone costs.

If it’s an option for you, the cheapest way to have a cell phone in college is probably staying on a family plan with your parents. I’m done with school, and I’m still on my parents’ family plan – though I pay my portion of it.

Even if you can’t do this, you can still find a very affordable cell phone plan. There are a ton of options – typical contract plans, prepaid plans, and lesser-known options. I’ll highlight three of them here:

- Ting – no-contract, affordable plans (not prepaid) that are based on your usage. You can easily customize your plan based on what you do most – talking, texting, or using data. Also, their customer service rocks.

- FreedomPop – holy buckets, it’s actually free! With some caveats.

If you don’t want to penetrate the confusing world of cell phone options, check out WhistleOut. It’s a site that helps you compare all the different plans and find the cheapest one.

Looking for ways to save money once you’re out of school? Check out these 25 techniques.

17. Find student discounts.

Don’t want to pay full price for stuff? Cool. Here’s a bunch of different student discount options you can take advantage of.

- StudentRate is an aggregator for student discounts – they list discounts on textbooks, laptops, clothes, travel, and other stuff.

- Apple has student prices for Macs and iPads – their discounts aren’t as good as they used to be, but they’re still something.

- If you’re a designer and need the Adobe Suite, you can get it for $20/month instead of $50/month. Check your bookstore; you might also be able to buy CS6 outright for a discount as well.

- Amazon Student lets you get Prime for half price, which includes free two-day shipping and their streaming music/video service.

- STA Travel and StudentUniverse both track student deals on flights.

- Discounted trips and adventures – many campus clubs are able to offer discounts to their members. At my school, the Outdoor Rec program lets students go on cool outdoor trips for cheap.

Local student discounts aren’t as ubiquitous as military discounts, but you can still key an eye out for these as well. To learn about even more ways to save as a student, check out our ultimate list of student discounts.

18. Take advantage of free stuff.

In addition to discounts, you’ve also got access to a ton of “free” stuff as a student.

Yes, your student fees pay for a lot of these – but those are fees that you can’t really opt out of, so taking advantage of these things basically makes them free.

- Free movies on campus – at my school, they show a new-ish movie in a big lecture hall every week (and they don’t even check for student IDs, bwahahaha)

- Workout facilities – your fees are already going towards super high-end gyms and workout centers; use them!

- Bus service – often free for students.

- Free condoms – when I became an RA, the health center literally gave me a bucket of these to pass out to my residents. Yeah… “Hey there, I’m your new RA! Want a condom?”

- Free lectures, guest speakers, and events – if you’re looking for something fun to do, attend these events.

- Laptop rental – many schools will let you check out laptops, cameras, microphones, and other tech equipment for free. When I worked in tech support, I knew several students who just kept doing this instead of buying their own laptops.

- FREE FOOD – it’s everywhere. It’s plentiful. You might have to sit through a sales pitch or something, but hey. It’s free food.

19. Get a credit card and be a deadbeat.

My first credit card wasn’t all that great; it gave me a $500/month credit limit and offered no benefits. However, using it for a couple years helped me to build up good credit, and I now have a nice card that gives me cash back on purchases.

After about a year of using it, I had built up about $300 in cash back – which I used to buy my girlfriend a PS4 for her birthday!

The key to using credit cards effectively is to be a deadbeat – that’s what credit card companies call people who always pay their bill on time, in full.

Credit card companies make no money on deadbeats, which is why they call us that. I’m ok with it, though.

Here’s what you should do to take advantage of this tip:

- Sign up for a credit card you’re likely to be approved for – NerdWallet has a list of student cards. Never get a card with an annual fee. Interest rate doesn’t matter because you’ll never pay interest – right?

- If you’re rejected for some reason, call up the company and explain why you want the card (to build credit) and that you’ll be responsible with it. Often, a call can sway their opinion.

- Set the card to auto-pay one or more of your bills. Doing this helps build your credit and might help you build rewards.

- Pay off the card’s balance in full every month. Think of it like another debit card.

If you choose to use the card on everyday purchase, then Alastor Moody has two words for you:

“Constant vigilance!”

You must remember to pay off the balance in full every month. Additionally, keep these things in mind:

- Using a credit card makes it easier to spend money frivolously. Use the next two tips to keep that spending in check.

- Try to only use 20% of your credit limit – i.e. $100 if the limit is $500 – as credit utilization is a huge factor in your credit score.

20. Use Mint to stay on top of your finances.

Peter Drucker – one of the most famous managers of all time – once said:

“What gets measured, gets managed.”

This is as true for your finances as it is for anything else. Once you know where your money is going, and how much of it you’re spending, you can start to make improvements.

The easiest way to do this is to use Mint, which is a free tool that tracks all your bank accounts, investments, and credit cards. It can track your loans, too! (But ReadyForZero might be a better option for those)

Simply set it up, then make sure to check it once or twice a week. It’s also got some nice budgeting features, so you can experiment with those once you’ve got a hang of what you’re doing.

21. Go uber-manual with your spending.

Maybe tracking your spending with Mint isn’t enough. Maybe you’re still finding that you spend too much day-to-day. What do you do?

Go uber-manual. That can mean a couple different things:

- Use only cash when you’re out and about

- Track all of your expenses with an app like Moni (iPhone) or One Touch Expenser (Android)

Either way, you’re forced to acknowledge the exact amount of money you’re spending every time you make a purchase. It’s a lot harder for your spending to get out of control when you’re doing this.

22. Haggle with your bills.

For the most part, it costs companies much more to acquire new customers than it does keep their current customers happy.

As a result, you can actually negotiate almost any monthly bill you’re paying. Don’t want to pay as much? Simply pick up the phone and tell them. Here’s a sample script you can use (with a bank fee as an example):

- You: “Hi there! I’m looking at my online banking, and I noticed I was charged an ATM fee. I’d like to have that refunded.”

- Rep: “Sure! We’ll go ahead and waive that fee for you.”

Will this always work? No – but there’s no harm in asking. Remember, most people won’t ask that one simple question. If you do, you open doors.

I’ve noticed that companies get especially eager to negotiate when you threaten to cancel. I cancelled service with several companies who are more than happy to offer me “secret deals” that cost way less than their normal pricing if I stay.

Don’t want to deal with this yourself? There’s a service called BillCutterz that can negotiate for you.

23. Create a 30-day “Impulse Buy List”.

How many times have you bought something on a whim, then realized a month later that you really didn’t need it?

When you find something randomly that you decide you want, put it on a 30-day list instead of buying it right away. You can keep this list in Evernote, Wunderlist, a notebook, or wherever.

Once in a while, check your list for any items you still want to buy. Odds are that many of the things on it will make you go:

“Why the heck did I want that?”

If you still want something, you know that it’ll likely add real value to your life. This ties in with the philosophy of minimalism – being deliberate about the things you value and the things you buy.

24. Be a shopping sniper.

My friends over at Listen, Money Matters have talked at length about being a shopping sniper, and even made a video about it:

Here’s the gist, though. Being a “shopping sniper” means:

- Knowing exactly what you need when you go to the store

- Shop as quickly as you can to avoid browsing

- Avoiding impulse buys, salespeople, and other distractions

Essentially, it just means staying focused on what you planned to buy in the first place. By doing that, you’ll save your wallet from a lot of unintended purchases.

25. Harm yourself deliberately.

Whoa now, things are getting a little emo in here…

Here’s what I really mean by “harm yourself deliberately”. Identify the less-than-useful activities and indulgences in your life that you truly enjoy, and then avoid all others.

I’ll use junk food as an example. There are two unhealthy foods that I really, really enjoy:

- Good booze – particularly craft beer and rye whisky

- Chocolate chip gelato

Mmm… booze and ice cream…

Wait, where was I? Oh yeah. Since I enjoy these two things, I have them semi-often. However, that also means you won’t see me mindlessly buying candy at the gas station, eating chips when I’m home, or getting a big tub of popcorn at the movies. I stick to what I like.

It can be really easy to mindlessly consume when we’re bored. Snacks at work, soda for a long drive…

If you can learn to avoid doing this – and learn deliberately choose the things you truly enjoy – you’ll save a lot of money (and your health).

On a related note, I think you should also be deliberate about the time you choose to spend on the things you enjoy.

Specifically, try to pack lots of high-fun activities – even if they’re “harmful” – into concentrated blocks of time instead of distracting yourself with low-density fun throughout the day (which just wastes your time).

Here’s a video I made on this subject:

26. Use your imagination for cheap dates.

Dinner and a movie? Easily a $50 night out.

If you’re looking for ways to save money, using your imagination to come up with alternative dates with your significant other is a great way to do it – and you get the added bonus of doing things that are actually better for your relationship.

Here’s what I did for my girlfriend’s birthday. The actual “date” portion only cost me about $20 – and could have easily been made cheaper.

Since my girlfriend is a gamer, I decided to devise an elaborate scavenger hunt that would make her have to find clues and solve mysteries to discover the location of her present.

Once she left for the weekend, I:

- Created a journal with an Assassin’s Creed-style code wheel she had to solve to find the URL of a secret website

- Built said secret website, which presented her with 9 different puzzles – each revealing a password

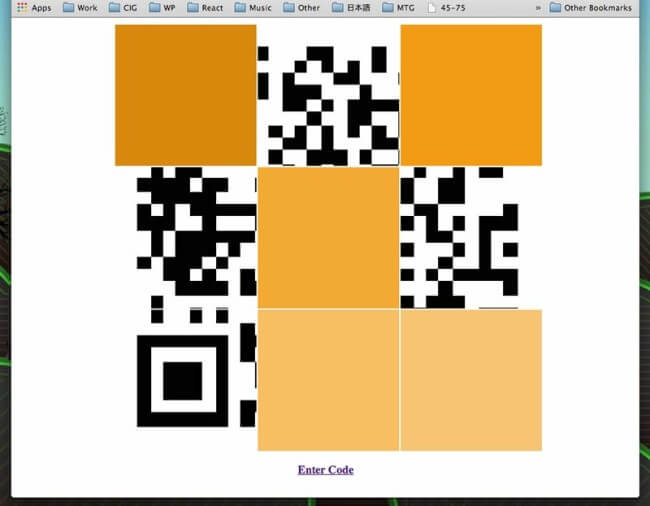

- With each password she found, site would reveal a portion of a QR code

- Once she solved them all, the QR code gave her the location of her present

I hid the passwords in all sorts of places. One was in the middle of a forest, one was hidden in a library book, and one was hidden inside a scrambled message that she had to use red-tinted glasses to read.

Another was locked in a box; she had to defeat me in a game of Joust to get the key. A few more were hidden inside logic puzzles.

The result? From start to finish, she and I had a good 8-hour day of fun exploring and solving the mystery together. I went along with her the whole time, dropping the occasional small hint.

27. Start investing early.

If you have no student debt, or are only using subsidized student loans that don’t collect interest until after you graduate, then it’s a good idea to start investing now.

As a sophomore, I opened a mutual fund at Vanguard and put $1,000 dollars into it. I didn’t invest a whole lot more while I was in college; however, it was able to sit there and collect interest while I finished my degree.

Now, I auto-invest a fixed amount every month. This isn’t day-trading; I’m not expecting huge returns right away. However, I know I’m likely to get a good return over the long run, and it’ll be quite high since I started young.

I think it’s a good idea to pay off your debt before you start investing; however, you can use a safe investment to collect some interest while you’re in school, then use it to pay down those loans later on.

Either way, pay off your debt and start investing as soon as you can. It pays off. To learn more, I’d recommend reading through An Introduction to Simple Investing.

28. Set up a spending firewall.

A firewall is a piece of software on a computer network that keeps intruders out of the system. You can apply this same concept to your budget by setting up a spending firewall – except, in this case, the system is your bank account and you’re the intruder.

To do this, simply keep whatever money you don’t need to have immediately available in a savings account instead of in your checking.

By doing this, you’ll have to think twice before making impulse purchases. Before you can actually buy something, you’ll have to go in and move funds around.

29. Save money at the bar.

I am a geek, so my personal strategy for saving money at the bar is:

“Eh, I’d rather stay home and read Harry Potter and the Methods of Rationality.”

However, I realize that bars can be a lot of fun for some people – and I do enjoy going out every once in a while. That said, here’s a good summary of my tips on saving money at the bar:

- Know your number – don’t leave home before you decide how much you’re going to spend. Then, stick to that number.

- Pay attention to drink specials, and start making a mental index of which bars are cheap on which nights.

- Pre-game… intelligently.

- Go easy on shots – they can get expensive quickly. Avoid impulse-buying them when the shot girl comes to your table.

- Plan the logistics in advance – know how you’re getting home beforehand so you don’t end up need an expensive cab ride

30. Become passionate about something.

Boredom is the enemy of your wallet. When you’re bored, you want consume. You want to start a DVD collection, buy video games, drink more, and upgrade things that don’t need upgrading.

My friend Tony Stubblebine – the founder of Lift – told me a great story when I interviewed him:

“When I wasn’t yet passionate about building my company, I spend weeks and weeks researching flat-screen TVs. I wanted the best one possible.

Now, I care about building Lift. If I even wanted to buy a TV, I’d just walk into the store and buy an inexpensive one without wasting time.”

When you’re passionate about something, you find yourself wanting to work on it all the time. As a result, you’re a lot less likely to get bored and go buy stupid stuff you don’t need.

For me, building College Info Geek has been a passion for a long time. I spend a ton of time working on it, which means I’m hardly ever bored.

I have other passions as well – reading, DDR, climbing trees, and others. These things keep both my mind and body active, and they don’t cost a whole lot of money.

31. Use your university library.

Here’s a simple equation I think we can all get behind:

“A love of books + a library = endless free fun” | Tweet This

I freaking love reading, and I can be entertained for a week straight with just one 700-ish page fantasy novel. If that novel costs me $10, that’s money well spent.

The library, however, is free. Which means your ROI for reading books there is essentially infinite; it doesn’t cost you anything, you become a better reader, learn new things, and you have lots of fun.

I’ve started doing weekly book recommendations on the CIG Facebook page, so you can follow along there if you’re looking for something good to read! My first recommendation? The Victorian Internet by Tom Standage:

Goodreads is another great place to find new books; it’s actually where I discover a lot of the things I read. If you like, you can be friends with me there as well 🙂

32. Practice mindfulness.

I’m not a yogi, and I’m not going to define mindfulness as some sort of “inner peace” or anything like that. My definition is much more practical:

“Mindfulness is being deliberately aware of your life’s dependencies, both in the now and with regard to your goals.” | Tweet This

My mother is a boss at mindfulness; I needed no further proof as a child than seeing her remember, out of nowhere, to ask us if we’d brushed our teeth that day.

Looking back, I can almost envision the whole subprocess running in her brain: “I love my kids, and their health is dependent on brushing their teeth, therefore I’m mindful of that and will check on it.”

Practicing mindfulness has been immensely useful for me, and it’s also saved/made me a lot of money. Here are a few examples of when being mindful helped me achieve my goals:

- I thought ahead before moving in my first apartment. As a result, I knew what the best option in town was and was one of the first to sign up. I was also able to secure space in the same building for 11 of my friends.

- I wanted to get an internship, so I made sure to start looking almost a year in advance. As a result, I received 8 interview offers and was hired for a great internship automatically. (Here are some of the tactics I used)

- Every semester, I remembered to set an alert for the moment class registration opened. As a result, I never had trouble getting into all the classes I wanted.

For more on mindfulness, check out my in-depth discussion about it on the Listen, Money Matters podcast.

33. Barter on Craigslist.

Alright, I just can’t hold it in any longer. I’ve got to tell you my ultimate frugality story.

During my sophomore year, there was a day in which I found myself about 3 miles away from my dorm. I was in the old part of Ames, where the busses did come – but it was the weekend, and the next bus wasn’t coming for like 45 minutes or some other unholy amount of time.

I didn’t want to wait. So, wandering around, I came across a discount bike shop. I go in and see a bike for $50, and I think:

“Yeah, I’m going to buy this and ride it home.”

So that’s what I did. I bought a bike just so I could ride home and skip waiting for the bus.

The next day, I put the bike on Craigslist. 48 hours later… somebody came by and bought it off me for $80.

My ride home cost me -$30! That’s a win in my book. And it’s also a segue into a good point: Craigslist is a great place for finding used stuff for cheap. You can find iPods, computers, bikes… well, anything. Even creepy stuff. Don’t contact the people selling the creepy stuff.

You can also sell things on Craigslist to make a little extra cash. One thing I did early in college was scraping together old computers, installing Linux on them, and selling them as complete desktops at a small profit.

If you do anything like this, though, be wary of scams.

34. Beware of peer pressure spending.

Friends are great, but friends also want you to do things with them. Things that cost money.

Sometimes, you won’t want to go do the things your friends want to do… not really, anyway. But they’re your friends. You’re supposed to be social, right?

This is where peer pressure spending comes into play. You didn’t really want to go see that mediocre movie, but your friends were going. You weren’t really in the mood to go to the bars… but you didn’t want to feel anti-social.

Peer pressure spending gets even worse when you’re dating someone. They’re going to want to go to an antique craft show that’s 40 miles away and has an entry fee – and you wouldn’t force them to go all alone, would you?

Some peer pressure spending is unavoidable. It’s part of like – just like any other form of peer pressure. It’s part of living in a social environment.

However, you can be mindful of it; learn to recognize it, and be willing to put your values first at times.

35. Learn some travel hacks.

At the random suggestion of one of my friends, I traveled to Japan right after my junior year ended.

In addition to having the time of my life, I also learned about lots of cool travel hacks you can use to save money while abroad. Here are a few:

- Set a price alert in Kayak for flights you want; then, wait until the price drops to a level you’re willing to pay – I saved around $250 on my Japan ticket this way

- Stay in hostels. They’re like hotels with fewer amenities – actually, they’re a bit like dorms. In Japan, I paid around $20-30 a night at most hostels, and I also learned that you can stay for free if you help clean! Hostelworld is my favorite site for booking them.

- Buying food at grocery stores and cooking it in the hostel kitchen is a great way to save money. Do this for most meals, then splurge on a few.

- If you’re traveling in a big city, rent a bike! It’s really cheap and ends up teaching you to navigate the city better than almost any other method of getting around

For more travel hacks, check out my interview with Travis Sherry – a travel hacking master!

36. Let VITA do your taxes for you.

If you have a part-time job, then you’ll probably find yourself filing your tax return each year – which is good, because you’ll probably get a refund.

Want to keep the money you would have spent paying for TurboTax? Use VITA – which stands for Volunteer Income Tax Assistance.

It’s a program that employs volunteer accounting students – who need to gain experience before getting their CPAs – to offer free income tax prep for anyone who makes less than $52,000 a year.

37. Track your educational expenses and deduct them from your income.

While you’re getting help from the cool people at VITA – or doing taxes another way – be aware that you can most likely deduct your educational expenses from your income – which will net you a bigger refund.

As a general overview, here’s what you can claim for deduction:

- Tuition expenses

- Fees that are required for enrollment in your school.

You can find more details about deducting education expenses here.

38. Get sales tax refunds on campus bookstore purchases.

Did you know that you’re eligible for a sales tax refund on your university bookstore purchases in certain states?

This is a very little-known tip, and even I’m not sure how many states it applies to. However, I do know it works in Iowa.

When I was a junior, an employee at my campus bookstore let me know that the things I bought there are supposed to be tax-exempt, but the bookstore charges sales tax anyway.

She also let me know that I could fill out Iowa Form 843, attach my bookstore receipts, and get the sales tax refunded. I did this, and got $75 back!

Value Penguin has a great blog post with more details on this process for every state that allows it.

39. Become Vorthox, Slaughterer of Debt.

Once you have student loan debt, the only way to “save money” on it is to destroy it as soon as possible.

You must slaughter it mercilessly. Crush it into the ground with the force of a thousand suns. Declare war on your debt.

Whether or not you choose to wear a medieval battle helmet while you do this is up to you. Either way, seek way to pay off your debt as soon as you can.

This is how I paid off almost $15,000 in student debt before graduating; I took every bit of income I made, deducted living expenses, and sent the rest packing to Sallie Mae.

Here are some strategies for becoming a Vorthox:

- Leave the minimum payments to those with weaker wills; pay as much as you can on your debt each month (though a smart warrior keeps an emergency war chest available)

- Make 100% certain your extra loan payments are going toward the principal balance of your loans, not being set up as future payments. Loan providers can be sneaky like that…

- Use the stack method to pay off your loans as fast as possible. Do the minimum payments to each of your loans, then apply all leftover money to the loan with the highest interest.

Now, Go Save Some Money

Boom. You’ve now got 39 ways that you can cut the cost of your college experience – 39 rubber bands to shoot that evil space maid.

If you want to learn more, here are some great resources that I’ve learned from:

As with all big lists of advice, don’t try to implement all of these strategies at once; you’ll simply overwhelm yourself. Pick a few, try them out, then come back and try others.