When I was a kid, I imagined that investing was something only middle-aged men in pinstripe suits did while screaming into cell phones. While I’ve since learned better, the media still tends to portray investing as a scary, complex topic that’s only for professionals or people with a lot of money.

Thankfully, this isn’t the case. You can start investing, even if you don’t have a lot of money or a degree in finance. What’s more, you should start investing ASAP, particularly if you want to live comfortably when you retire.

But how do you start investing? In this guide, I’ll show you how. It’s much easier and much less expensive than you probably think.

Note: I am not a financial advisor, nor do I pretend to be one on the internet. This article is for educational purposes only and is not investment advice.

Why You Should Start Investing

Why should you bother investing at all? Isn’t it risky? Isn’t your money safer under your mattress or in a savings account?

While it’s true that investing has risks, it’s actually less risky than keeping money under your mattress. Aside from the obvious risk of all your money getting stolen or destroyed in a fire, the invisible forces of inflation will also slowly destroy the value of your money.

The average annual inflation rate is around 3%. This means that each year, prices increase by around 3%.

This doesn’t sound like that much, but that 3% really adds up over time. If you keep all of your money in cash, it will lose value very quickly even if you continue to accumulate more money.

But what about keeping your money in a savings account where it earns interest?

The average interest rate for U.S. savings accounts is around 0.9%, according to the FDIC. Even if you have a bank that offers 3x that, it’s still not enough to keep up with inflation.

This is why just stashing money in a savings account will rarely give you enough money to live on when you retire. No matter how much you save, inflation will continue to make that money less and less valuable.

To have enough money to live on when you retire, you need to start investing.

What Is Investing?

So what exactly is investing? That’s a huge question, but at its most basic form investing means buying something that you expect to increase in value. This could be literally anything, from a piece of land to an antique bidet.

Investing 101: Stocks and Bonds

When most people talk about investing, however, they’re referring to investing in stocks, bonds, or collections of both.

A stock is simply a piece of ownership in a company (or “share”) that you can buy and sell. When investing in stocks, you hope that the shares you purchase will go up in value, allowing you to ultimately sell them for a profit.

Bonds, meanwhile, are a special type of loan that governments (and sometimes corporations) use to raise money for projects.

When you buy a bond, you’re essentially loaning money to a government or corporation with the expectation that they’ll pay you back the original amount plus interest. This makes bonds less risky than stocks, though your potential profit from them is also lower.

So should you invest in stocks or bonds?

Stocks have the benefit of potentially making you more money, but they’re also riskier than bonds since the company’s stock could lose value or even fail completely.

Bonds are a much “safer” investment, but this also means less potential reward. Therefore, it’s smart to invest in both and spread out your risk. This is known as “diversification.”

ETFs: “Baskets” of Stocks and Bonds

Investing in a few different stocks and bonds is better than investing in a single stock or bond, but it’s still quite risky.

If all of the stocks in your portfolio (your collection of investments) do poorly, you could lose a lot of money. And by only investing in a few companies, you could also miss out on potential gains when other companies are doing well.

Instead, it makes more sense to spread your money out over many different stocks and bonds. This way, the performance of the stocks and bonds averages out to a better overall return.

Luckily, there’s an easy way to invest in large collections of stocks and bonds without having to buy them individually. It’s called an exchange-traded fund (ETF).

A “fund” is a collection of many different stocks and bonds (often hundreds or even thousands). And “exchange-traded” means that the fund trades on a major stock exchange.

In addition to offering you lots of diversification, ETFs have a couple of other advantages:

- ETFs are affordable – You don’t need thousands of dollars to purchase an ETF, which makes them a great choice for a beginner investor without a lot of cash.

- ETFs are hands-off – You don’t have to do tons of research to choose the stocks and bonds or take the time to buy them individually.

- ETFs are easy to automate – Some brokerage accounts (the service you use to buy ETFs) let you set up automatic contributions from your bank account. This way, you can make consistent contributions without having to think about it. M1 Finance – our pick for the best beginner investing platform – even lets you do it for free.

Other Types of Investing

This above was a very broad overview of the type of investing that you can get started in without a lot of money or specialized knowledge.

There are other worthwhile types of investing (such as real estate investing and investing in mutual funds), but we won’t be discussing those in this article since they generally require larger amounts of money, time, and research.

The Power of Compound Interest

Compound interest is the reason that you should invest for the long-term. It describes earning interest on top of additional interest, and it allows your money to grow exponentially. The best way to understand it is with a simple example:

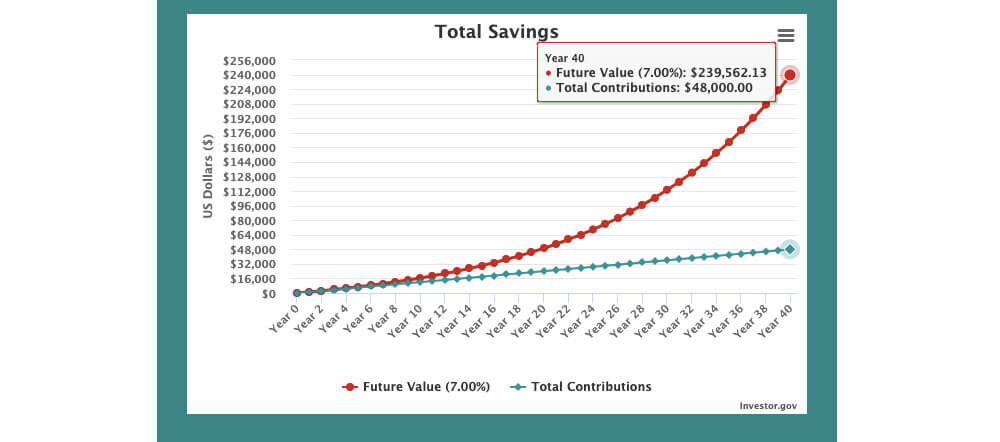

Imagine that you save $100 a month for 40 years. At the end of this time, you’ll have saved $48,000. While that isn’t a small amount of money, it’s nowhere near enough to live on.

Now, imagine that instead of just saving the money, you invest it into ETFs. You expect that, on average, you’ll earn 7% interest on this money each year. Now how much money will you have after 40 years?

Answer: $239,562.13

Here’s a graph showing the same information. The blue line represents the money you contributed each month, while the red line represents how much money you’ll expect to earn with interest:

If you want to play with the numbers yourself, here’s the compound interest calculator I used to create the graph.

A 3-Step Plan to Start Investing (Even Without a Lot of Money)

Now that you understand how investing works in theory, we can discuss how to start investing. Before I go any further, note that the approach we describe below isn’t the only way to invest.

Instead, it’s an approach that’s easy to stick to, doesn’t require a lot of money, and is based in sound investing principles from people a lot smarter than we are. I’ll include links throughout if you want to dig into the details behind this approach.

1. Max Out Your 401(k) or IRA Contributions

If you have a 401(k) or another employer-sponsored retirement program, max out your contributions to that first. We recommend this for two reasons:

1. Tax Savings

The money you contribute to your 401(k) is tax-deductible, meaning it can reduce the amount of income you pay taxes on (potentially placing you in a lower tax bracket and thus lowering your income taxes). For 2021, you can contribute up to $19,500 to your 401(k), so your tax savings could be significant.

2. Free Money

Many employers will match contributions you make to your 401(k) up to a certain amount. If your employer offers this, then you should always contribute at least the amount that your employer will match. This is literally free money; don’t leave it on the table.

If you’re not sure if your employer matches contributions, ask the person who handles employee benefits.

When to Open an IRA

What if your employer doesn’t offer a 401(k) or another type of retirement plan? In this case, we recommend you open an IRA (Individual Retirement Account) and max out your contributions to it.

IRAs don’t have the same kind of employer match, and the annual contribution limit is lower ($6,000 as of 2021). However, IRA contributions are tax-deductible.

You can open an IRA through most brokers, including M1 Finance (which we’ll discuss next).

2. Invest the Rest with M1 Finance (Our Top Pick for Beginner Investors)

If you still have money left to invest after maxing out your 401(k), or if you’re looking for a great place to open an IRA, we recommend M1 Finance.

M1 lets you automatically invest your money in ETFs (exchange-traded funds). As we already mentioned, ETFs are one of the best ways to get started investing. They have no investment minimums, they spread out your risk, and they’re easy to automate.

But why do we recommend M1 specifically? After all, it’s far from the only service that lets you invest in ETFs.

While it’s not as well-known as other investment services such as Betterment, M1 has the most competitive fee structure we’ve found. Unless you’re doing something weird and unnecessary like getting paper statements, M1 won’t charge you any fees to have or use your investment account.

This sets them apart from the other brokers we’ve reviewed. Just take a look at the fees that these other popular investing platforms charge:

- Betterment – 0.25% annual fee

- Wealthfront – 0.25% annual advisory fee

- Fidelity – 0.5% fee for automatically investing in ETFs (through their “hybrid robo-advisor” plan)

- Stash – $3 / month fee to have an IRA account.

To get started with M1 Finance, sign up here.

3. Don’t Touch Your Investments

The way that movies portray investing may give you the impression that you need to constantly monitor the stock market and be ready to change your investments at any moment.

While this is necessary for professional investors such as day traders, it’s a huge waste of time for average investors like you and me.

Remember: you’re investing for the long-term. This means that you shouldn’t care what happens to the market in the course of a week, month, or even year. Whether returns are low or high now doesn’t matter. You only care about average returns over the course of decades.

When the market is doing poorly, it will be very tempting to withdraw all of your money to avoid “losing” cash. Resist this temptation!

If you freak out when the market is doing poorly, it will prevent you from investing consistently. And consistency is what makes this investment strategy work.

Common Investing Mistakes to Avoid

Congratulations! You now have all of the information you need to start investing. However, I want to include a few common investing mistakes to watch out for so that you don’t lose a lot of money.

1. Taking Investment Advice from Friends/Family

At some point in your life, a well-meaning friend or family member is going to tell you how you must invest in such and such company or asset because it’s a “once in a lifetime opportunity.”

Whenever someone tells you this, you should politely ignore them. While it’s possible that your Uncle Joe or college roommate found a good investment, it’s extremely unlikely. Stick to your simple, boring investment strategy instead.

2. Trying to Beat the Market

In the age of the internet, it’s tempting to think that, with enough research, you can find some secret investing opportunity that will allow you to “beat the market” (earn higher than average returns).

However, it turns out that almost no one can beat the market, not even professional investors. According to data from S&P Dow Jones Indices, 95% of active fund managers fail to outperform the market.

And remember, these are professionals who spend years studying finance and hours each day reviewing financial reports. If even they can’t beat the market most of the time, why should you expect to?

You’re better off just investing your money in ETFs and not obsessing over the “best” possible investment strategy.

3. Trying to Get Rich Quick

I know I’ve already said this several times, but it’s worth repeating: invest for the long-term.

While it is possible to make a large amount of money in a day or even an hour with the right stock trades, it’s also extremely difficult, unpredictable, and a great way to lose a lot of money quickly.

Plus, don’t you have better things to do than look at graphs of the stock market? Unless you’re a day trader, stick to the type of boring, passive investing we describe in this article.

If you’re looking for smart ways to earn some extra money in the short-term, check out our guide to making an extra $1,000 a month.

4. Withdrawing Money When the Market Performs Poorly

I’ve said it before, and I’ll say it again: don’t freak out when the market does poorly. You’re a long-term investor, so short-term fluctuations don’t matter to you.

Common Investing Questions Answered

To finish this guide, here are the answers to some questions new investors commonly have.

What returns should I expect over the long-term?

Investing returns are a tricky topic. Depending on who you talk to, you’ll get different answers about what kind of returns you should expect.

When investing in ETFs, however, it’s safe to assume an average annual return of around 7%. This is the number you get when you average the yearly returns for the S&P 500 from the 1950s to the present.

The S&P 500 is a very reliable indicator of the overall stock market performance, so you can be fairly safe assuming 7% returns.

And remember: 7% is the average. In a given year (or even decade), the number can fluctuate a lot.

Should I hire a financial advisor?

Probably not, particularly when you’re starting out. Once you’re a millionaire, it might make sense to hire one, but it’s generally an unnecessary expense.

How much money do I need to start investing?

If you invest in ETFs through M1 Finance, you can contribute as little or as much as you want. And there are no minimums for contributing to your 401(k) or IRA (though there are maximum annual contributions).

So if you’ve been holding off on investing because you “don’t have enough money,” you can’t use that excuse anymore.

Should I invest or pay off debt?

If you have debt with an interest rate higher than 5%, you should pay it off before you start investing.

Why 5%? Assuming you earn an average return of 7% on your investments, that means your net returns will still be at least 2% even if you’re still making debt payments. 2% is a significant return (higher than most savings accounts), so it doesn’t make mathematical sense to give that up just to pay off low-interest debt slightly faster.

However, if being in any amount of debt causes you stress or disgust, then it could still be worth it to pay off your debt before you start investing. This was Thomas’ perspective when he paid off his student loans. Sure, he lost out on potential investment returns for a bit, but it was worth the psychological benefits of being debt-free.

Looking to pay off your student loans faster? Check out our guide to refinancing student loans.

Does it cost money to invest?

Yes, but not very much. The funds that your 401(k) or IRA are invested in have fees, and so do investments you make through many brokerage accounts.

As long as you use M1 Finance, however, you won’t pay any management, advisory, or withdrawal fees. Again, this is why it’s our top recommendation for beginner investors.

If you have 401(k) through work, though, there could be much higher fees. You should be able to see the fees on your monthly 401(k) statement. If the fees are excessively high (more than 1%), it could be a better idea to invest your money yourself through an IRA.

1% doesn’t sound like a lot, but it can add up to 10s or even 100s of thousands of dollars of lost money over the course of your lifetime.

Start Investing Today

This article covered a lot of ground, but you should now understand the basics of how to invest your money. More than anything, I want you to take action on the advice we laid out here and start investing today.

The earlier you start investing, the more compound interest will work to your advantage. So start putting your money to work! Max out your contributions to any retirement plan your employer offers (especially if they match contributions).

And if your employer doesn’t have a retirement plan, consider opening an IRA through a company like M1 Finance (which you can also use to invest any cash you have left over after maxing out your employer’s retirement plan).

The best time to start investing was yesterday. But you can still get started today.

Image Credits: $100 bills