Budgeting gets a bad reputation in our culture. When we hear a friend is “on a budget”, our first reaction is to feel sorry for them. We view budgeting as painful self-denial, something that takes all the fun out of life.

Done properly, though, budgeting can be empowering and even life-changing. You just need to find the budgeting approach that works for your goals and life situation.

To help you make budgeting a part of your life, we’ve put together this guide. We’ll start with a look at what budgeting is, as well as why budgeting can be so transformative. Then, we’ll examine eight principles you can use to create a budget you’ll stick to.

What Is a Budget?

In the context of personal finance, a budget is just a plan of how you’ll spend your money. Budgets can be as simple as a set of general principles, or as complicated as a spreadsheet with dozens of line items.

We’ll get more into the details of how to make a budget later on in this article. But first, why would you want to make a budget at all?

3 Reasons You Should Make a Budget

If you’re not sure that budgeting is for you, here are three reasons to consider making it part of your life:

Take the Fear and Stress Out of Personal Finance

One of the scariest things in life is the unknown. And if you don’t know where your money’s going, that can be quite scary indeed.

With a budget, you remove the frightening ambiguity from your finances. Knowing where each dollar is going, you don’t have to wonder if you’ll have enough money to cover your expenses.

And with extra money to spare each month, you know you’ll be able to provide for yourself if you lose your job.

Get Out of Debt

To get out of debt, you need to either increase your income or reduce your spending. Only then will you have the extra money you need to accelerate your debt payments.

Making a budget forces you to reckon with how much you’re spending on everything. And once you’ve listed out all your expenses, you’ll probably find a few things to cut. This could be the source of the cash to help you get out of debt faster.

After you’ve paid off your debt, budgeting can also help you stay debt-free. In particular, your budget ensures that you only spend the money you have. This will keep you out of credit card debt.

Increase Your Options

Ultimately, budgeting can increase the options available to you in life. When you break the paycheck to paycheck cycle, you can start planning for the future.

Having a budget in place lets you:

- Save for a downpayment on a home

- Donate to charity

- Start investing

- Put money away for your children’s education

- Invest in a business idea

Without a budget, it’s much harder to make these long-term financial plans.

8 Principles of Successful Budgeting

I don’t know your situation, values, or priorities. Therefore, it wouldn’t be very helpful for me to tell you exactly how to budget.

Instead, I’m going to outline eight principles that will help you create a budget personalized to your life. Feel free to take what’s useful and discard what isn’t.

Track Your Spending

If making a budget sounds like too much work, start with tracking your spending.

I consider this the gateway to budgeting. You’re becoming aware of your expenses and your spending habits, but you’re not trying to change anything yet. Your goal is just to get in the habit of paying attention to your money.

There are many options for tracking your spending, but here are some of our favorites:

- Mint – This free app connects to your checking, savings, and credit card accounts. It will then show you a weekly report of how much you spent (and on what).

- Spreadsheet – For a more hands-on approach, track your spending in a spreadsheet.

- Note on your phone – It may not be the most elegant way to do it, but odds are good you have your phone with you any time you’re spending money.

Try tracking your expenses for a month. You’ll probably find you spend less just because you’re paying attention.

Need help building the habit of tracking your expenses? Learn how to form a new habit with our free course:

Building habits isn’t just about discipline; there are real-world steps you can take to set yourself up for success! In this course, you'll learn how to set realistic goals, handle failure without giving up, and get going on the habits you want in your life.

Know Your Minimum Expenses

One of the biggest hurdles for new budgeters is figuring out how much to budget on different expenses. Some of this knowledge comes from experience. But for many expenses, it’s just a matter of sitting down and making a list.

Because of this, a great way to get started budgeting is to calculate your minimum expenses. This is the minimum amount of money you need to survive every month. Not enough to live a high-quality life, but enough to keep you alive.

Your minimum expenses will include:

- Housing (including utilities)

- Food

- Transportation

If you have debt, then be sure to include your minimum debt payments as well. Yes, technically you could still survive without paying your debts, but the long-term consequences are dire enough that we don’t recommend it.

Once you’ve calculated your minimum expenses, you can use those numbers as the basis of your budget. From there, it’s just a matter of figuring out what you’ll spend on all the other “non-essential” things.

Determine Your Financial Priorities

Now that you know how much money you need to survive, you need to decide how you’ll spend what’s left. From fun things such as travel to wellness-boosting activities such as a yoga membership, there are a lot of decisions to make here. And you only have a limited amount of money to work with.

Knowing this, you need to determine your financial priorities. This is a matter of figuring out what you value and then aligning your spending with that.

For instance, let’s say you really love skiing. Because this is a priority, you decide that you’ll spend less on eating out. That way, you have more money left over for that next epic weekend on the slopes.

It would be great if you had enough money to do every little thing that seems interesting or fun. But in the real world, you have to make tradeoffs. Deciding your financial priorities will help you make these tradeoffs with confidence.

Budget for Large, Recurring Expenses

Most budgeting approaches work on a monthly basis. Some expenses, however, don’t come up every month. Because it’s easy not to think about these larger expenses, it can be a rude surprise when they’re due.

To keep from getting caught off guard, make a list of all your large, recurring expenses. Then, divide each of those numbers by 12. That’s how much you should budget every month for each large expense.

For instance, let’s say you have a National Parks Pass ($80 / year). Dividing by 12, you know you need to budget $6.67 each month to pay for the pass when it comes up for renewal.

The same philosophy applies to other large expenses in your life, including:

- Insurance premiums

- Software subscriptions

- College tuition

- Quarterly estimated tax payments (if you’re self-employed)

Budget for Fun Things

Your budget isn’t just about paying for groceries and rent. It’s also about helping you put money towards the things you enjoy.

So when you make your budget, don’t be puritanical. Don’t pretend that you’ll never go out to eat, get a latte, or buy Austin Powers action figures.

It’s your money, and it’s fine to spend some of it on things you enjoy. The key is to plan your discretionary spending so you know you still have enough for the essentials.

Therefore, make sure your budget includes categories for your hobbies and other fun pursuits. Otherwise, you’re just lying to yourself.

Make Your Budget Flexible

No one can predict the future, and you shouldn’t expect your budget to, either. No matter how thoughtful you are in your planning, life will have other plans. So it’s smart to account for these unexpected happenings in your budget.

Specifically, we recommend having an “Unexpected Expenses” or “Stuff I Forgot to Budget For” category. This is especially helpful when you’re new to budgeting, as there are likely expenses you haven’t thought of.

If you don’t need the extra money, great! Put it towards debt payments or investing.

View Your Budget as Always Evolving

While budgeting is simple in theory, there’s a lot to learn about the finer details. Instead of getting frustrated when your budget doesn’t align with reality, view it as a learning experience.

Your budget, after all, is never “done.” It continues to evolve as you get better at managing your money and your priorities shift.

If you accept this reality, then you’ll be much more likely to stick with budgeting long-term. But if you expect budgeting to change your life instantly, you’ll only find disappointment.

Find the Budgeting Method That Works for You

You may notice that I haven’t mentioned a specific budgeting system so far. This is by design. As I said in the beginning, budgeting is very personal. The method that works great for one person might infuriate another.

Thus, it’s tricky to recommend one budgeting method. The best approach is to try a few systems and find one you like.

To help you get started, I’m going to suggest three different budgeting tools. Each represents a distinct approach to budgeting. All can work, but most likely you’ll find that one approach resonates with you more than the others.

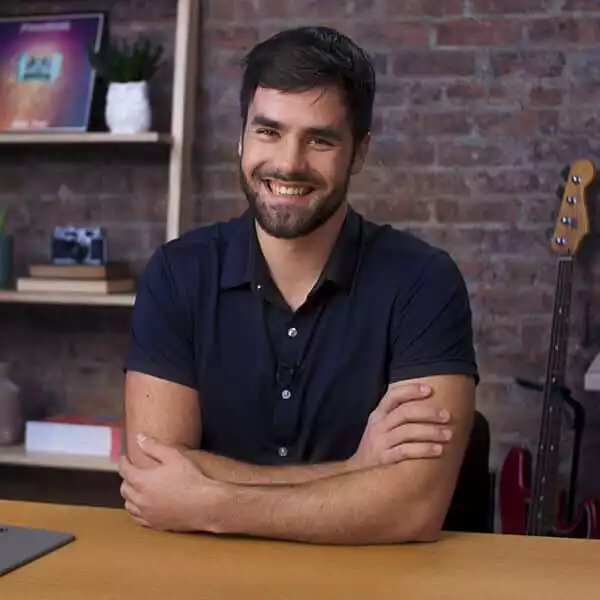

Flexible Budgeting and Tracking with Mint

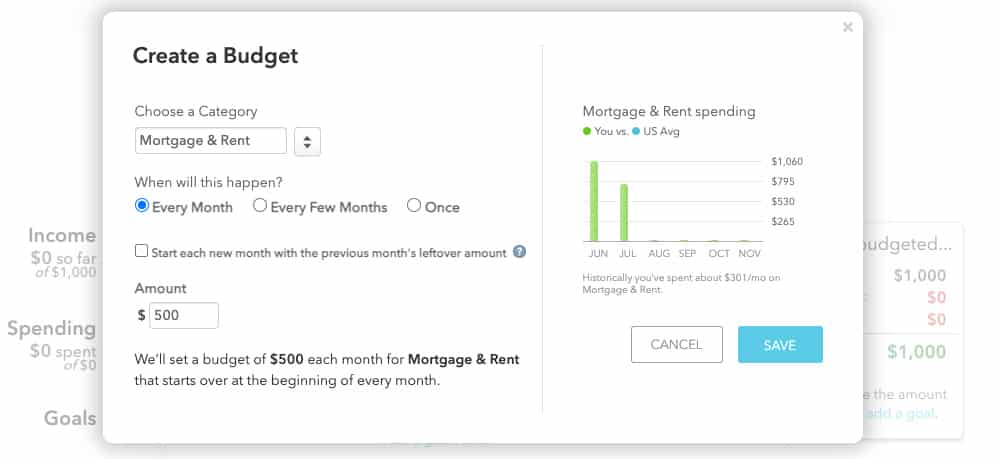

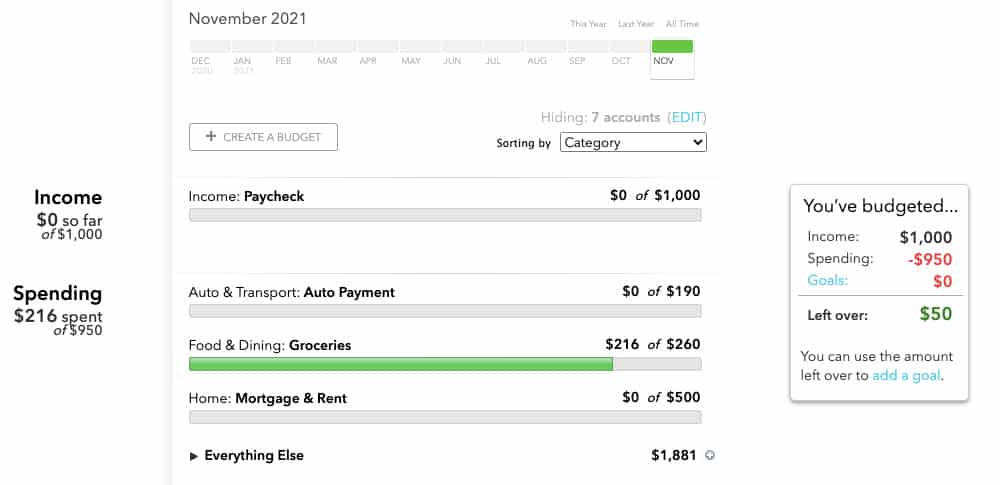

I already mentioned Mint as a way to start tracking your spending. However, you can also use Mint to make a more detailed budget.

Budgeting in Mint is based around categories. First, you tell Mint how much you want to spend on a particular category.

Then, Mint will track your spending and alert you if you’re about to go over budget.

Mint’s budgeting tools won’t give you as detailed a financial picture as some of the other approaches we discuss below.

But if you’re new to budgeting, the automated tracking features remove a lot of the work. And this could be the motivation you need to start taking control of your money.

Hands-On Budgeting and Expense Tracking with You Need a Budget

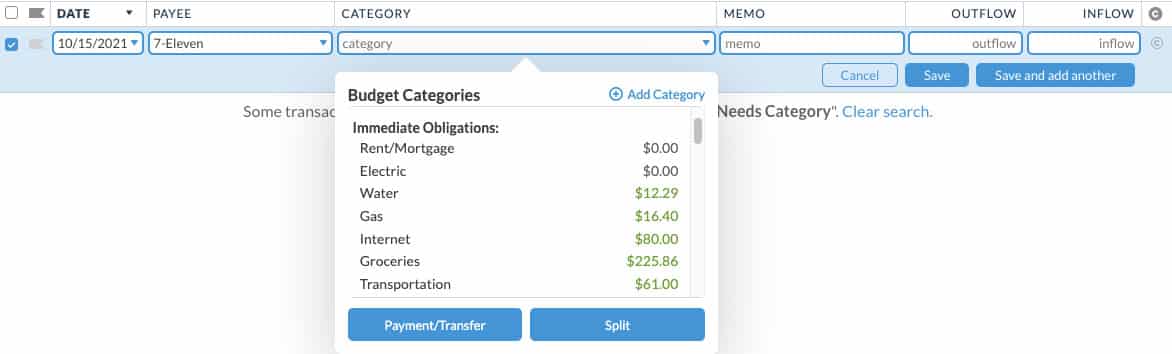

You Need a Budget (YNAB) is an app that makes you pay very close attention to your money.

To start, you create a budget with estimates of what you’ll spend on different categories. Each time you spend money, you have to assign it to a category in your budget.

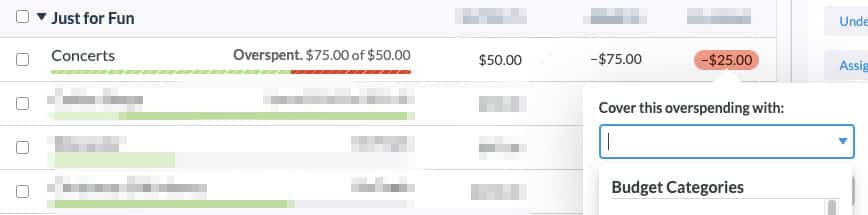

If you overspend on a category, YNAB will prompt you to cover that spending with money from elsewhere in your budget. This way, you never use debt to cover overspending.

While it sounds rigid, YNAB is actually very flexible. If an unexpected expense comes up, you adjust your budget categories accordingly. Your YNAB budget won’t “break” just because life throws you a curveball.

Learn more about YNAB:

Making a detailed budget can be transformative. If you want to budget for every expense before it comes up, then You Need a Budget (YNAB) is the best app out there. Along with sophisticated tools for budgeting, it also teaches you how to better manage your money. Click the button below to try YNAB free for 34 days.

Detailed Financial Planning with a Custom Budget Spreadsheet

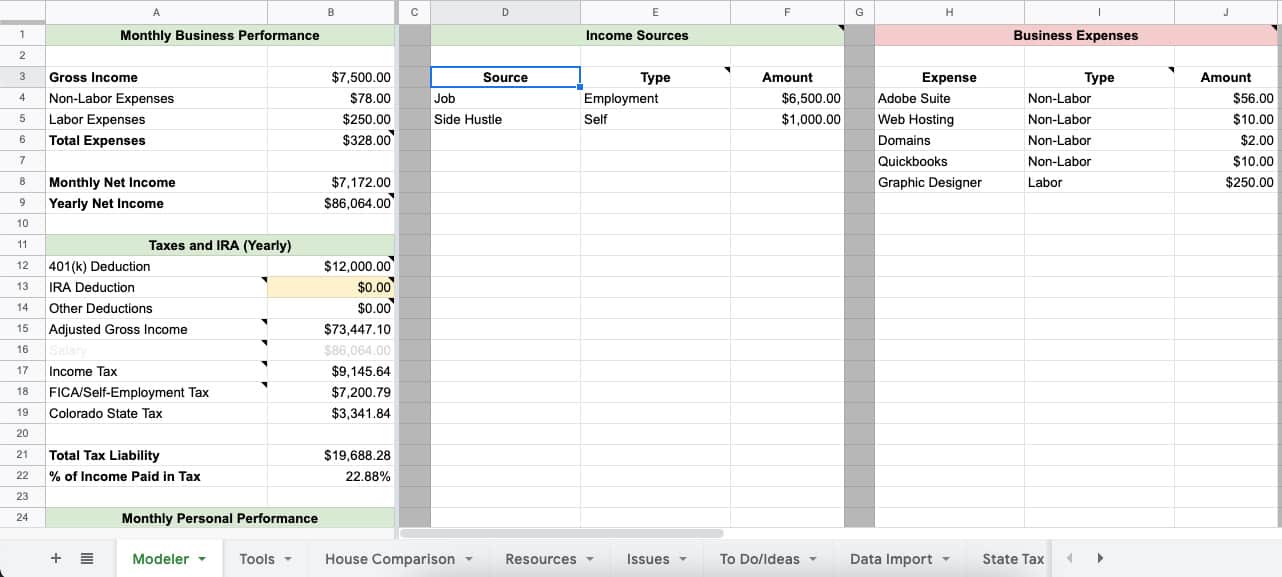

If the features in Mint or YNAB seem limited to you, you might prefer making your own budget spreadsheet. That’s what Thomas, the founder of this site, decided to do. He created this “Budget Modeler” spreadsheet to help manage his finances.

As with all budgets, Thomas’ spreadsheet includes places to track your income and expenses. However, it also includes some “advanced” features that you won’t find in other budgeting software.

Mainly, the budget modeler includes tools for estimating tax liability. If you’re self-employed, you know how tricky this can be. Using data customized to your state and city, as well as information on business expenses and retirement contributions, the spreadsheet gives a rough estimate of how much you’ll have to pay in taxes.

If you’re interested in tracking things with this level of detail, then I encourage you to give Thomas’ spreadsheet a look. Once you make a copy of the Google Sheet, you can customize it to your heart’s content.

Dip Your Toe Into Budgeting

Now that you’ve read this article, budgeting should be less mysterious and intimidating.

We’ve shown you some options for getting started, but don’t get too hung up on the method. Ultimately, the goal is to find a budgeting system that helps you accomplish your financial goals.

Looking for more budgeting tools? Check out our list of the best budgeting apps.

Image Credits: hands stacking coins