Have you ever thought about getting a job on campus? There seem to be so many options.

You’ve probably seen other students working at the bookstore, the on-campus subsidized coffee shop, or manning a desk at the library. Chances are, they’re probably doing it through the Federal Work-Study Program.

So what is it? How do you apply? And what happens once you qualify?

Understanding how the application process works, how you get a job, and how you get paid can all be a little confusing, but we’re here to help. Here’s how the Federal Work-Study Program works, as well as 5 caveats to consider before applying.

What is Federal Work-Study?

The short answer is that it’s a way to help pay for college.

The long answer? Well, it’s a program funded by the government that offers a grant of money determined by several different factors. You access the money by working part-time either on-campus or for a partnered employer off-campus.

Qualifying for it isn’t as tricky as it sounds. I promise.

How Do I Qualify?

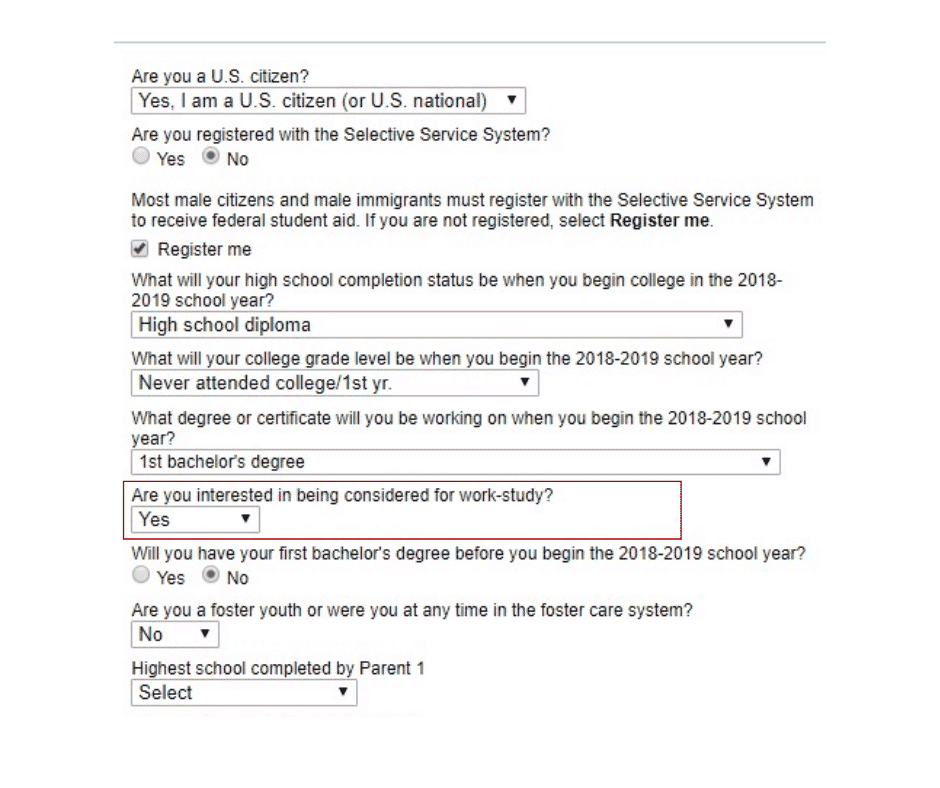

Federal Work-Study is one of the easier financial aid programs to apply for. You don’t have to write an essay, have perfect grades, or do much beyond filling out your FAFSA.

Of course, there is one big base requirement. Like any other financial aid program, you have to be a U.S. Citizen/U.S. National, or a holder of a permanent resident card or I-94 card from the USCIS.

According to the Federal Student Aid website, the biggest factor in qualifying is just filling out your FAFSA early. Each year, the US government assigns a limited amount of money to each participating school. Once the funds are allocated, poof: no more Work-Study grants are available. The early bird really does get the worm in this particular scenario.

All you have to do is fill out your FAFSA and check the box that asks whether or not you want to apply for a Work-Study Program. Then, you wait to hear back.

…So I Qualified. Now What?

Great! That wasn’t so bad, was it?

You’ve probably been told that you’ve been allocated a certain grant. Say, $3000.

That money isn’t available to you just yet. Think of it more like a job offer than free money. Now, you have to find a position and start earning that money.

Your next step should be to contact your school’s financial aid office and ask about available Work-Study positions. You’re going to have to apply and interview for these positions just like any other job. The responsibility of acquiring a position and earning that grant money is entirely on you.

What Kind of Jobs Are Available?

Depending on your school, you’ll have a few different options:

1. On-Campus Jobs

The most common type of position available will be on-campus. These jobs are usually pretty flexible and very convenient for you, considering you won’t have to travel much for work.

Usually, they include things like administrative work, teaching assistant work, manning the library and printing labs, or even working at the on-campus coffee shop. At my community college, we even had taking care of the on-campus farm as an option.

2. Community Service

A small percentage, about 7%, of available positions are required by the government to give back to the community.

These usually come in the form of reading tutors for small children, working with English As a Second Language classes in your local area, or offering your time as a mathematics or literacy tutor.

3. Off-Campus Jobs

Another percentage of available positions will be off-campus with participating employers.

These jobs are a great choice if you can snag one. They’re required to be relevant to your coursework, so you get some real-life valuable work experience. They also offer the chance to make some connections you can leverage when you finish school.

How Am I Going to Be Paid?

If you get the job, the school is required to pay you at least every month. You’ll be paid with a paycheck or direct deposit unless you specifically request otherwise.

Some schools will apply your paycheck directly to tuition if you ask them to. Some schools have the option to pay you in cash. If that’s something you’d prefer, then it doesn’t hurt to at least ask.

How much you get paid is super dependent on the job. By law, they have to pay you at least the federal minimum wage. If you’re an undergraduate, that’s what you’ll likely be paid. If you’re a graduate student, you have a chance at a salary, depending on what kind of job you land.

This all sounds good in theory, right? But there are still a couple of things you should know about the Work-Study Program before applying and hunting for a position.

Five Caveats:

1. You Can’t Work As Much As You Want

Remember, you have to think of this more like a contract position than a grant or regular job. If the government allots you a $3000 grant, you can only work up to that $3000 mark.

Sure, you’re welcome to go to your financial aid office and ask to work more, but there’s no guarantee that they’ll let you.

2. Pay Will Vary, and Hours Worked Will Vary

We touched on this in the previous section, but keep in mind that there isn’t a set hourly amount that you’ll be paid, or a set amount of hours you will work.

Most Work-Study programs will work around your student schedule, and you’ll probably get somewhere in between 10-20 hours per week, but how much you get paid for those hours is completely dependent on the kind of work you’re doing.

Some students will get paid the minimum wage. Some students will have a slightly higher salary.

3. Work Study Funds Aren’t Applied Directly to Your Tuition

Unlike other grants and federal aid, the money you earn through the program is meant to be a paycheck. It won’t be applied directly to your housing or tuition. It’s meant to help you pay for smaller expenses, like food, textbooks, and other living costs while you study.

4. Work Study Funds Aren’t Guaranteed Year-to-Year

Just because you qualify one year doesn’t automatically mean you’ll qualify the next. It sucks, but it’s true. So, be vigilant about applying and get your FAFSA filed early every year.

Sometimes things change, and the amount of money you’re earning and the amount of financial aid you’re receiving changes year-to-year and will affect whether or not you qualify for Work-Study.

5. Just Because You Qualify for a Grant, Doesn’t Mean You Have a Job

We can’t emphasize this enough. Even if you get the news that you qualify for a grant through the program, that money isn’t automatically available to you.

You still have to do the work of checking in with your financial aid office and ensuring that your school even participates. You’ll have to check and see whether or not there are positions available.

Then, you’re going to have to go through the work of interviewing for those available positions. On the plus side, many colleges give work-study students a priority window to apply for on-campus work, so you do have a little bit of a leg up on the system.

Federal Work-Study Benefits

So, what’s the point of even signing up? Well, there are three big benefits that come with participating in the program:

1. Funds You Earn Don’t Count Against You on Your FAFSA Next Year

This is huge. Unlike a regular job or other financial aid, the money that you earn while working through the program is deducted from your FAFSA. Make sure you keep track of your earnings for the following year so you can get the most money deducted possible!

2. Earn Work Experience and Make Connections

A recent study shows that employers still prefer relevant work and life experience over a perfect GPA.

They like to see job candidates who play a role in their surrounding community, with different hobbies, an active social life, and marketable skills.

That means you shouldn’t neglect the rest of your life while you’re in college. Absolutely still focus on your studies and get good grades, but make sure you’re a well-rounded individual, too.

The Work-Study Program helps with that. The skills you learn while working in your school’s administrative office, helping your professor grade papers, tutoring students in the library, or working off-campus at a law office or in a community garden will look great on a resume later.

Who knows? You might even meet someone who can mentor you or who will work as a great reference later when you’re trying to find a job straight out of college.

3. A Flexible Work Schedule

Unlike other jobs you might work while in college, partnering employers expect that you have a student schedule that will change often and will need to be accommodated.

They’ll be more understanding of your needs a student, and they’re often on-campus so you won’t need to take a long commute to work.

If you get lucky, you might be able to squeeze a shift in between your classes. The positions at my school offered shorter-than-normal shifts (2-4 hours, rather than 6-8).

Many of them will also be warm-body jobs, meaning that you can sit and work on your homework when you have nothing to do. Jobs like manning the library or working a sales desk at your university bookstore come under this category.

Make Work-Study Work for You

If you have the room in your schedule for part-time work and you need the money to help pay for college (and, honestly, who doesn’t?), then it doesn’t hurt to at least apply for the Federal Work-Study Program.

Hopefully, this guide has cleared up some of the confusion you might have around how the program works and how to apply and qualify.

If you’re looking for more tips on how to earn and save money while in college, here’s some more recommended reading:

- 39 Ways to Cut the Cost of College

- How to Budget and Save Money as a College Student

- How to Balance College and Full-Time Work

Image Credits: featured