Money may be the root of all evil, but it’s certainly much easier to do good if you’ve got it.

Along with wisdom and health, it’s an essential ingredient for personal freedom, and yet a discouragingly large amount of us are living paycheck to paycheck, one setback away from financial ruin.

We’re talking a bit about money management today, in the hopes that we can all get financially stable or die tryin’.

Things mentioned in this episode:

- Mint

- The Ultimate Guide To Budgeting In College

- Daily Budget for iOS

- Daily Budget alternative for Android

- Tom’s net worth tracker

- Tom’s budget modeler

- Ku Cha House of Tea

- Listen Money Matters

- Credit Karma

- Nerdwallet

- Nerdwallet – Best College Student Credit Cards of 2017

- A Crash Course on How to Start Investing (Even If You’re in Debt) (Ep. 168)

- How One Recent College Grad Intends to Retire at 40

- Mr. Money Mustache

Want more cool stuff? You can find all sorts of great tools at my Resources page.

Timestamps:

- 0:00:28 – Some info about the tea

- 0:02:12 – Defining your financial goals and retiring like Mr. Money Mustache

- 0:12:44 – Automating payments and finances in general

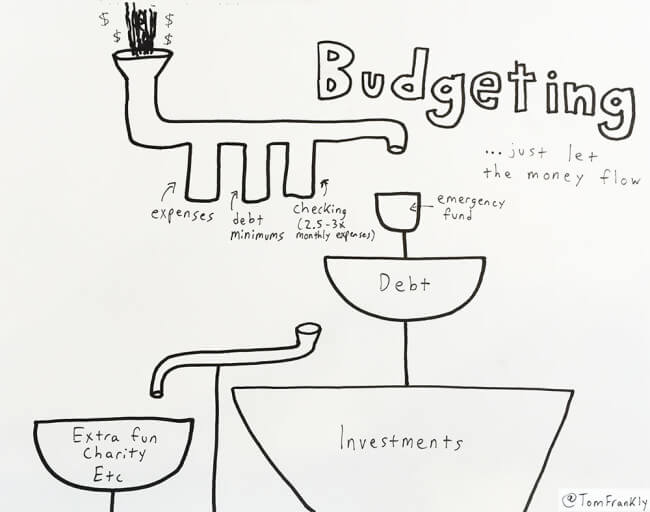

- 0:16:50 – Visualizing your finances through the money pipeline analogy

- 0:18:03 – Filling up the essential money pipeline “buckets”

- 0:26:57 – Managing the remaining “buckets” based on your personal needs

- 0:35:15 – Dealing with non-monthly, yet predictable expenses

- 0:37:43 – Sacrificing fun and happiness in favor of important expenses

- 0:43:32 – Sponsor: FreshBooks (Working as a freelancer)

- 0:46:17 – Martin’s budgeting method

- 0:55:08 – Keeping track of expenses and more on trading happiness for money

- 1:06:32 – Tips and benefits of using credit cards

- 1:15:55 – Being a deadbeat vs having a lot of credit card debt

- 1:22:36 – Recap and conclusion

If you enjoyed this episode, subscribe to the podcast on iTunes! It’s easy, you’ll get new episodes automatically, and it also helps the show gain exposure 🙂 You can also leave a review!

Here’s an image for sharing this episode on social media: