I used to think budgeting was for other people.

Sure, I’d tried budgeting software like Mint. I’d even tried creating a budget in a fancy spreadsheet. But generally, I’d either forget to update the budget, or I’d get tired of the app telling me how much money I’d spent the previous month. Budgeting seemed nice in theory, but it “just didn’t work for me.”

So when a coworker recommended I look into You Need a Budget (YNAB), I was skeptical.

Oh great, I thought, another personal finance app that claims it will change my life. After using YNAB for the past month, however, I’m excited to say it’s not like all the other personal finance apps out there. It’s given me a level of control and optimism that I’ve never felt about my money before.

Now, I’m convinced that while budgeting may not be for everyone, it can make a huge difference in your life if you do it the right way. If you’ve been interested in budgeting, or just want to try a different way of managing your money, then YNAB could be the solution you’re looking for.

To help you decide if you should give YNAB a try, we’ve put together this review. Below, I’ll take a look at the pros and cons of YNAB, as well as how it differs from other personal finance apps. In the end, you’ll be able to tell if the app is right for you.

The Problem with Most Budgeting Apps

Until I started working on this review, I couldn’t pinpoint why I never stuck with budgeting apps such as Mint or Personal Capital. They seemed like a great idea: a unified view of all my financial accounts, plus detailed reports on my spending each week. With this much information at my fingertips, I would finally be in control of my money.

Or so I thought. What I now realize, however, is that those apps did nothing to change my behavior. They provided me with lots of information, but they didn’t help me take action.

Here’s what really happened:

- At the end of each month, I’d get a report showing what I’d spent.

- I’d think something like, “Dang, I spent a lot eating out last month.”

- Finally, I’d feel a bit guilty and then continue with my usual ways.

To be clear, this was just my experience. I’m not saying that apps like Mint or Personal Capital are useless. If they help you make better financial decisions, then please keep using them.

But if you’re dissatisfied with the state of your finances and looking for a different way of managing your money, then YNAB could be for you. Keep reading to find out what sets it apart.

Need help creating a budget? Read this next.

How Does YNAB Work?

Before I get into specific pros and cons, I’ll give a brief overview of how YNAB works. This way, you can see how it differs from other budgeting and personal finance apps.

Create Your Budget

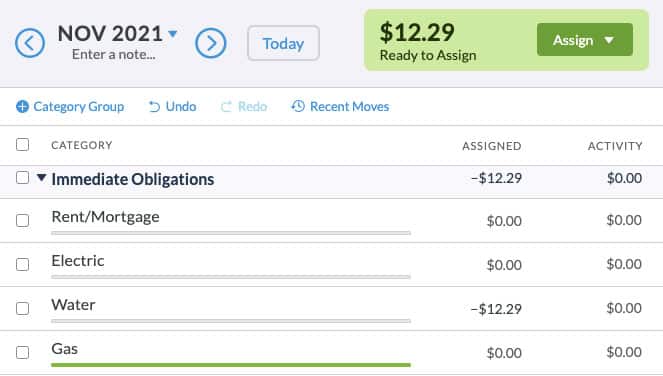

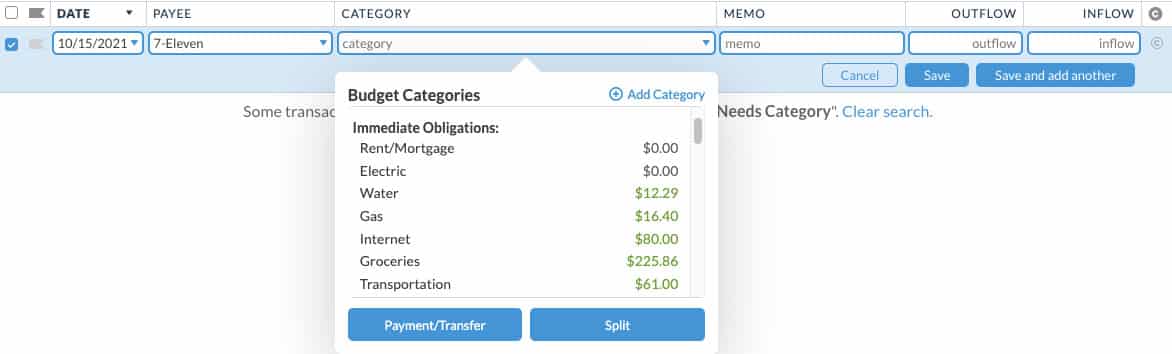

At its core, YNAB is a budgeting app much like you’re used to. The app’s main screen is a list of general categories of expenses such as “Immediate Obligations” and “Debt Payments.” Within each of these general categories, you’ll find more specific items such as “Rent” or “Student Loan Payment.”

As with other apps, you assign the amount you plan to spend to each item in your budget. But unlike with other apps, these amounts aren’t arbitrary numbers.

Instead, YNAB uses the amount of cash available in your bank account to tell you how much you have available to assign. You can’t assign more money than you have, which helps you avoid debt.

Record Your Transactions

Once you’ve created your budget, the real work begins.

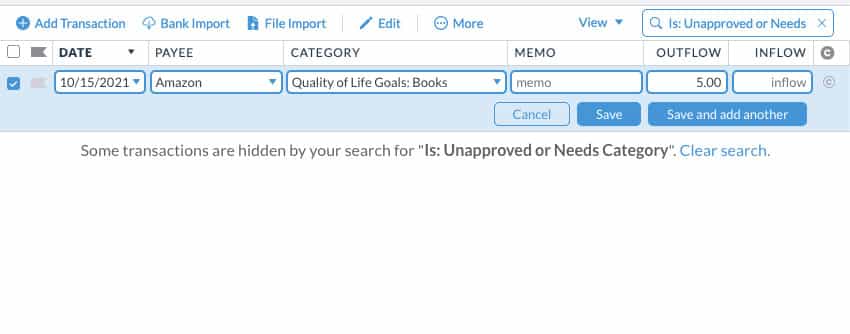

Each time you make a purchase, you’ll need to record it in the YNAB app with the appropriate budget category. This spending then gets deducted from your budget.

Alternatively, you can link your bank or credit card to YNAB and have it automatically import transactions for you.

Only Spend What You Have

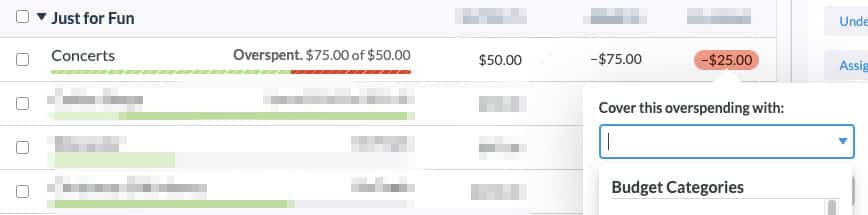

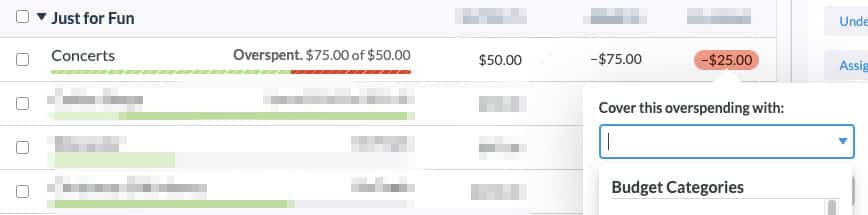

If YNAB detects that you’ve spent more than you budgeted on a category, it will make you move that money from another category to cover the overspending. This is a flexible approach that ensures you won’t go into debt.

There’s a lot more to YNAB than the above, but those are the important basics to understand. With that information in mind, we can move to the pros and cons.

Making a detailed budget can be transformative. If you want to budget for every expense before it comes up, then You Need a Budget (YNAB) is the best app out there. Along with sophisticated tools for budgeting, it also teaches you how to better manage your money. Click the button below to try YNAB free for 34 days.

YNAB Pros

We have a lot of good things to say about YNAB. The following are some of the features and benefits that set the app apart:

Zero-Based Budgeting Puts You in Control

At the core of YNAB is a philosophy called “zero-based budgeting.” Put another way, this means that you give every dollar in your account a job.

With this approach, you’re fully in control of how you spend (and save) your money. It may seem like a subtle psychological shift, but we’ve found the benefits to be immense.

Mainly, I feel less stressed and more optimistic about my finances. In the past, there was always some uncertainty between what I had spent on my credit card, what I had in my checking account, and what I was going to earn the following month. Now that every dollar has a job, I don’t have to guess.

As a side effect, this has created a virtuous cycle where I actually enjoy looking at my budget. I no longer dread it since I know I’m in control.

Accountability Meets Flexibility

Most budgets are just about making a plan. YNAB, however, holds you accountable to that plan.

How does it hold you accountable? By forcing you to categorize every single transaction you make. Whenever YNAB sees a transaction on one of your accounts, it will ask you to assign it to a category in your budget.

Once you’ve done this, YNAB will add/subtract that transaction amount from the amount available in that budget category.

Especially when you’re starting, you’ll probably overspend on a category. If so, that’s fine — your budget isn’t ruined. Instead, YNAB will tell you that you’ve overspent and prompt you to move money from another category to cover the overspending.

This approach has two benefits.

First, it prevents you from spending more money than you have.

But beyond that, it ensures that your budget won’t “break” the moment you deviate from it. And as we all know, the moment your budget stops working, it’s easy to say Forget this and revert to your old ways.

Encourages Financial Mindfulness

YNAB has helped me be far more mindful of my money than ever before. When I signed up for the app, I was annoyed to learn that I couldn’t link my credit card account to YNAB (it is possible in theory, it just didn’t work with my card).

But after discussing it with my teammate Martin, he encouraged me to try logging all of my purchases manually using the YNAB mobile app. I was skeptical, as this was a radical departure from the automatic tracking of apps like Mint.

However, I discovered that this “bug” in the YNAB software is actually a feature for me. Since I have to log every single thing I purchase, I’m far more mindful about what I spend. In many cases, simply knowing I’ll have to log a purchase is enough to prevent impulsive spending.

The other night, for instance, I was thinking about ordering pizza for dinner. But after looking at what I had available to spend in my “Dining Out” category, I decided that I didn’t want to put $20 towards pizza. I’d rather save that money for a fun dinner out with friends.

If this manual logging approach sounds like a pain, well, it kind of is at first. But that’s the point. The logging step adds a barrier between you and the all too easy impulsive spending that’s possible with digital payments.

However, you can make things a little easier by signing up for transaction alerts from your bank or credit card issuer. This way, you’ll have texts reminding you to log transactions in YNAB. Again, you don’t have to use YNAB this way, but you’ll probably get more benefit out of it if you do.

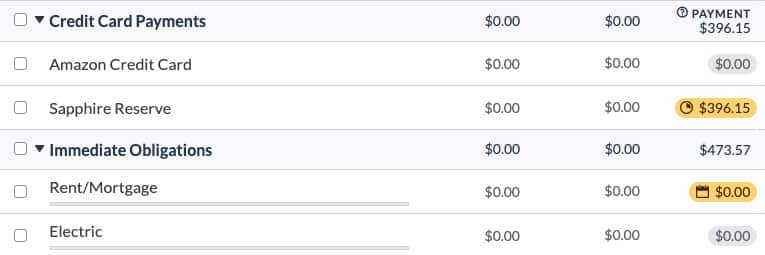

A Clever Approach to Credit Cards

When you buy something with a credit card, you create debt. Hopefully, that concept is obvious. What might not be so obvious, however, is how that debt affects the money you have available to spend.

YNAB removes this ambiguity using a special “Credit Card Payments” budget category. Whenever you make a purchase on a credit card, YNAB moves that money from the relevant budget category into “Credit Card Payments”.

The effect is that you’re always aware of the debt you’ve created. Plus, the way YNAB handles credit cards helps you avoid something called the “credit card float.”

If you’re “riding the float,” then you’re spending money on your credit card, waiting to get paid, and then using that income to cover the credit card bill. This is an unsustainable approach that can leave you in a bad spot if you lose your job.

YNAB helps you flip the script, forcing you to budget using only money you currently have in your checking account. Furthermore, it encourages you to pay off credit card debt ASAP. I’ve found that paying the card off once per week works well, as I can also use that time to reconcile all of my account balances with the numbers in YNAB.

Note: If you start using YNAB and discover you’re riding the float (i.e., you have credit card debt that you can’t cover with your current cash on hand), YNAB can also help you create a plan to get out of debt. Learn more here.

An Unconventional Approach to Saving

When you first create your budget in YNAB, you may notice that there isn’t a “Savings” category. Indeed, when telling you how much money you have available to budget, YNAB doesn’t distinguish between your savings and checking account.

I found this odd until I read this explanation. YNAB’s philosophy is that your budget is your savings category. That is, giving every dollar a job is how you ensure that you’ll have money left over to save.

You can still create specific savings categories, however. Indeed, YNAB encourages you to do this for all kinds of things.

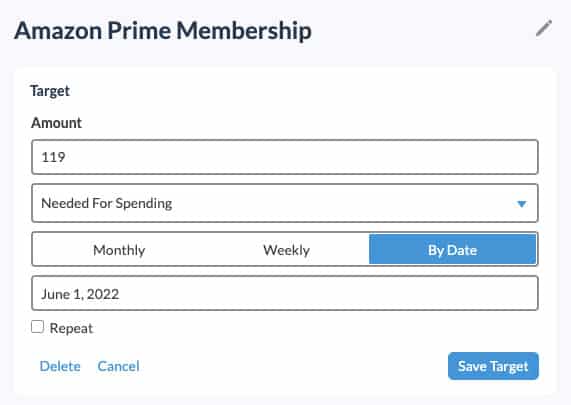

To start, there’s saving for large annual expenses. For instance, let’s say that you pay $119 a year for an Amazon Prime membership.

Instead of just “dealing with it when it comes up,” you can create a Savings Balance Target to have $119 saved whenever your membership renews. YNAB will then calculate how much you need to save each month to reach your target on time.

If you’re new to budgeting, this level of planning can seem a bit intense. But once you get used to it, it’s quite liberating. Especially because you can also use YNAB’s tools to save for fun things.

If you want to take a beach vacation, for example, you can create a savings target for it and add money to the category each month until you have enough.

And because YNAB forces you to cover overspending with money from other categories, you may think twice about buying that new gadget if it cuts into your vacation savings.

Helps You Break the Paycheck to Paycheck Cycle

Are you living paycheck to paycheck? If so, then YNAB will help you break the cycle. But what does this look like in practice?

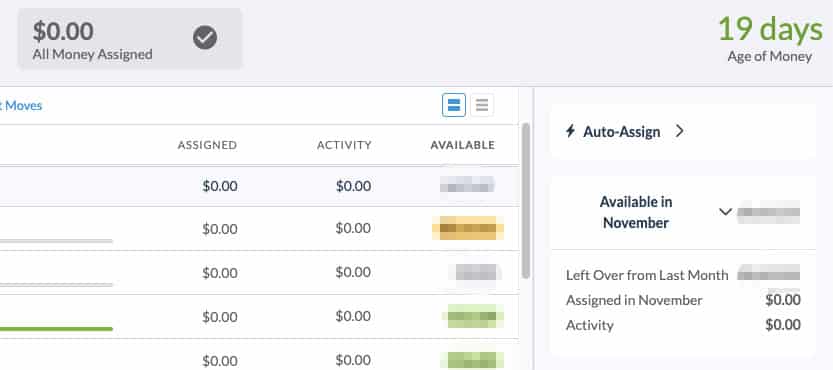

One YNAB feature that I haven’t encountered elsewhere is the “Age of Money” metric. This number, which is constantly visible in the upper right corner of the “Budget” screen, tells you how long the money you’re spending has been in your bank account.

That number will probably be low when you get started. But eventually, the aim is to get your “Age of Money” to be 30 days or higher. When this happens, it means you’re now living off last month’s income. Which is another way of saying you’re no longer living paycheck to paycheck.

Now, don’t expect your money to get that old after just a month. The process will probably take a few months of budgeting (or longer, depending on what state your finances are in when you start). But knowing you’re on the path to greater financial security will keep you motivated throughout the process.

YNAB Cons

As you can now tell, we have a lot of positive things to say about YNAB. But that doesn’t mean it’s perfect. Below are some of the cons we’ve encountered while testing the app:

The Truth Can Hurt

YNAB forces you to take a hard, honest look at how you’re spending your money. While this is the only way to make progress in the long run, confronting your true spending can be a rude awakening.

If you’re more comfortable with only a vague understanding of your money, then YNAB isn’t for you. But if you’re ready to finally change your financial habits, it will provide the dose of reality you need.

Learning Curve

Even if you’ve created a budget before, you may find the YNAB interface a bit confusing at first. The app has a pretty solid “Get Started” process, including a guided tutorial that shows you the basic features. However, I found that YNAB didn’t really “click” for me until I’d used it for a week.

Mostly, this is because the app requires you to do a bit more work than you may be accustomed to. Making a budget requires decisions (sometimes hard ones). Tracking your spending requires a bit of extra thought. And some of the YNAB jargon takes getting used to.

Fortunately, YNAB offers a 34-day free trial. This is long enough to get practice using all of the app’s features and decide if it’s right for you.

Paid Subscription

If you’ve ever used Mint, you’ll know that most of the features are free. Or rather, you don’t pay with dollars. Instead, Mint makes money by using your financial data to recommend offers from their partners. Whenever you purchase one of the promoted products or services, Mint gets a cut.

YNAB, in contrast, charges a subscription fee. Currently, the app costs $14.99 / month. If you chose to pay annually, it’s only $98.99 (an $80 savings compared to paying monthly).

In our experience, the savings you’ll get using YNAB mean that the app more than pays for itself. For instance, if budgeting for eating out gets you to buy one less $20 meal per month, then you’ve already covered that $14.99 cost and then some.

Of course, the best way to see how much YNAB can save you is to sign up for a free trial. They don’t even require a credit card to sign up, so you have nothing to lose except debt and financial stress.

No Automatic Investment Tracking

YNAB goes all-in on being a budgeting app, and nothing else. So if you’re looking for tools to help you monitor the performance of your investments, you should look elsewhere (Personal Capital is a great option to consider).

You can track your investment balance within YNAB, but you’ll have to update it manually. And you won’t get any analysis of your portfolio or advice on how much you need to save for retirement.

YNAB can help you budget for those monthly retirement savings (or help you reduce your spending so you have more to save). But that’s where its investment-related features end.

Want to start investing? Here’s how.

Is YNAB Right for You?

Overall, we heartily recommend You Need a Budget to anyone who wants more financial control and less financial stress.

If you’re looking for a free app, an app to track your investments, or an app that will pat you on the back and tell you to keep up the good work, then YNAB isn’t for you.

Otherwise, we encourage you to give it a try. Learn more below:

Making a detailed budget can be transformative. If you want to budget for every expense before it comes up, then You Need a Budget (YNAB) is the best app out there. Along with sophisticated tools for budgeting, it also teaches you how to better manage your money. Click the button below to try YNAB free for 34 days.

Image Credits: jar of coins